The Two Minute Review

TSB is a solid bank, and its Spend & Save Plus account might be attractive to some people. However, there are more rewarding accounts on offer from competitors. It is also middle of the market in terms of customer service.

PROS

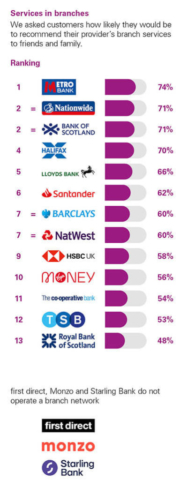

- 🏦 Has a large branch network (though this is smaller than the “big 4” banks).

- 😊 Straightforward to open an account.

- 📱 Nicely designed app with round ups feature and saving pots.

CONS

- 💰 Other banks give better rewards.

- 📈 Interest on overdrafts can be high.

Ranked #15 of 25 personal current accounts in the UK.

What The Experts Say

“If the performance of a customer app is a key factor for you when deciding who to bank with, TSB may not be your first choice.”

What Users Say

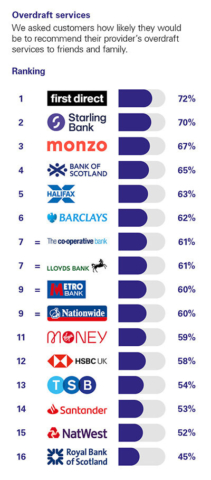

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put TSB in equal 14th position.

Click to see the full picture.

4/5

TSB has a Trustpilot rating of 4 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 1.74. In terms of organic Trustpilot rating this means TSB is number 11 out of the 25 personal banks/current accounts we review.

3.7/5

At the last check, Smart Money People had collected 547 reviews which gave TSB an average score of 3.7 out of 5.

The Deepdive

TSB in a Nutshell?

TSB is a British bank that was founded in 1839. It has over 5 million customers and over 1,200 branches. In April 2013, the bank was taken over by “Banco Sabadell”, the 4th largest bank in Spain.

TSB Bank aims to be a customer-centric bank, offering a range of digital tools and services to help customers manage their finances more easily. They also have a focus on community and claim to “exist to help local people and the communities they live in to thrive”.

How to Apply for a TSB Current Account

It will take about 10-15 minutes to apply online or via the app. You will need to be over 18, a UK resident and need to be able to provide one of each of the following:

- Driving licence (UK/EU/EAA), UK passport, EU/EEA identity card.

- Driving licence, utility bill, bank statement, council tax bill.

What Accounts Does TSB Offer?

There are two main accounts worth going for at TSB – the “Spend & Save” and the “Spend & Save Plus”. Here is how they compare.

| Spend & Save | Spend & Save Plus | |

| Account fee | Free | £3 |

| Arranged overdraft limit | £2000 at 39.9% default interest | £2000 at 39.9% default interest |

| Interest-free overdraft allowance | None | £100 |

| Monthly cashback | £5 for 6 months | £5 ongoing |

| Using card abroad | Fees apply | No Fees |

| Savings pots and “save the pennies” feature | Yes | Yes |

| Auto balancer feature | Yes | Yes |

| “Returned item fees” i.e. fees for declined transactions when you have no money in your account | £3 | 0 |

So the main positive is that both accounts will pay you £5 a month. However, the free account will only do this for 6 months. There are also some strings attached. In order to get the fiver you will need to make 20 debit card payments each calendar month.

Both accounts also have 5 individual savings pots attached to the account. You can assign them a name, a picture and a regular savings schedule (e.g. put £50 in each month on the 25th). You will get 2.52% interest on these pots for the first year – which is OK but certainly not the best rate on the market. After a year this drops to 0.6% and at such a time we’d definitely advise you to find a better rate for any savings pots you have.

There are a couple of other features we don’t really like.

- Standard interest on overdrafts is a hefty 39.9% EAR.

- The 2.99% transaction fee for using your card abroad on the Spend and Save Account (this is waived on the premium account).

How Good Are The App & Digital Banking?

The app has a modern, clean design that is super intuitive. TSB has also been busy catching up with the challenger banks by adding some nice features:

- Save the pennies: This allows you to round your transactions up to the nearest pound and transfer the difference to a TSB savings account. So if your weekly shop came to £28.30, this would be rounded up to £29 and 70p would be added to your savings account.

- Auto balancer: Allows you to set a minimum level of your balance. If you go below this, TSB will automatically take money from your savings account and keep you above this threshold.

- Savings pots: Easy access savings pots (explained above).

You can of course see your balance, make transfers, see transactions (including pending transactions) etc. However, you can only see the last 3 months of transactions which can be a bit of a pain.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5*

Better than most

Been a member of TSB for years because they always give a good service, always looking to help if they can. Also, understanding of needs of disabled is better than most. Physical access to the bank is acceptable. TSB offer better security than most.

Critical

1*

Very bad online facilities.

They used to be excellent online bankers, but now I can’t get anything useful from them online. Contacting them is all but impossible. I am very disappointed and feel I have to switch after almost 20 years.

2*

Going downhill

I’ve been with Lloyds, which became Lloyds TSB, and now TSB, for almost 30 years. For almost all of that time, they were pretty good – great service, and the Platinum account was pretty good value when it first came out.

I’m now finally getting round to downgrading my Platinum account to a free one. I’d been meaning to do it for ages due to the deteriorating value (higher price, fewer features), but recent poor service has tipped me over the edge. No point listing all the instances – they’re mostly minor but do add up – but being turned away today from trying to pay cash into my account was the last straw. If you’re not able to deposit cash, then what’s the point of a local branch? Apparently handling cash is “too expensive, we wouldn’t be able to keep the (city centre) branch open”.

Is TSB a Good Bank?

TSB is ranked #15 of 25 personal current accounts in the UK (click to see full list).

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.