After a small hiatus, switching offers are back. Both NatWest and Lloyds are running pretty attractive offers.

You'll need to switch a non-NatWest account to a reward account with them. You will also need to pay in £1,250. The £200 is then paid within 7 days.

If you have previously held a NatWest, UBS or Ulster Bank account since January 2020 you won't be eligible.

Check NatWest's website for full details.

An oldie, but still a goodie.

Lloyds may not stand out, but it's a dependable bank and its customer service is pretty decent. The £175 switching offer makes it pretty attractive to anyone looking for a new bank.

You will need to switch from another bank (including 2 Direct Debits) and by Thursday 28th March. For full conditions see Lloyds' website.

Any Other Rewards I Can Get?

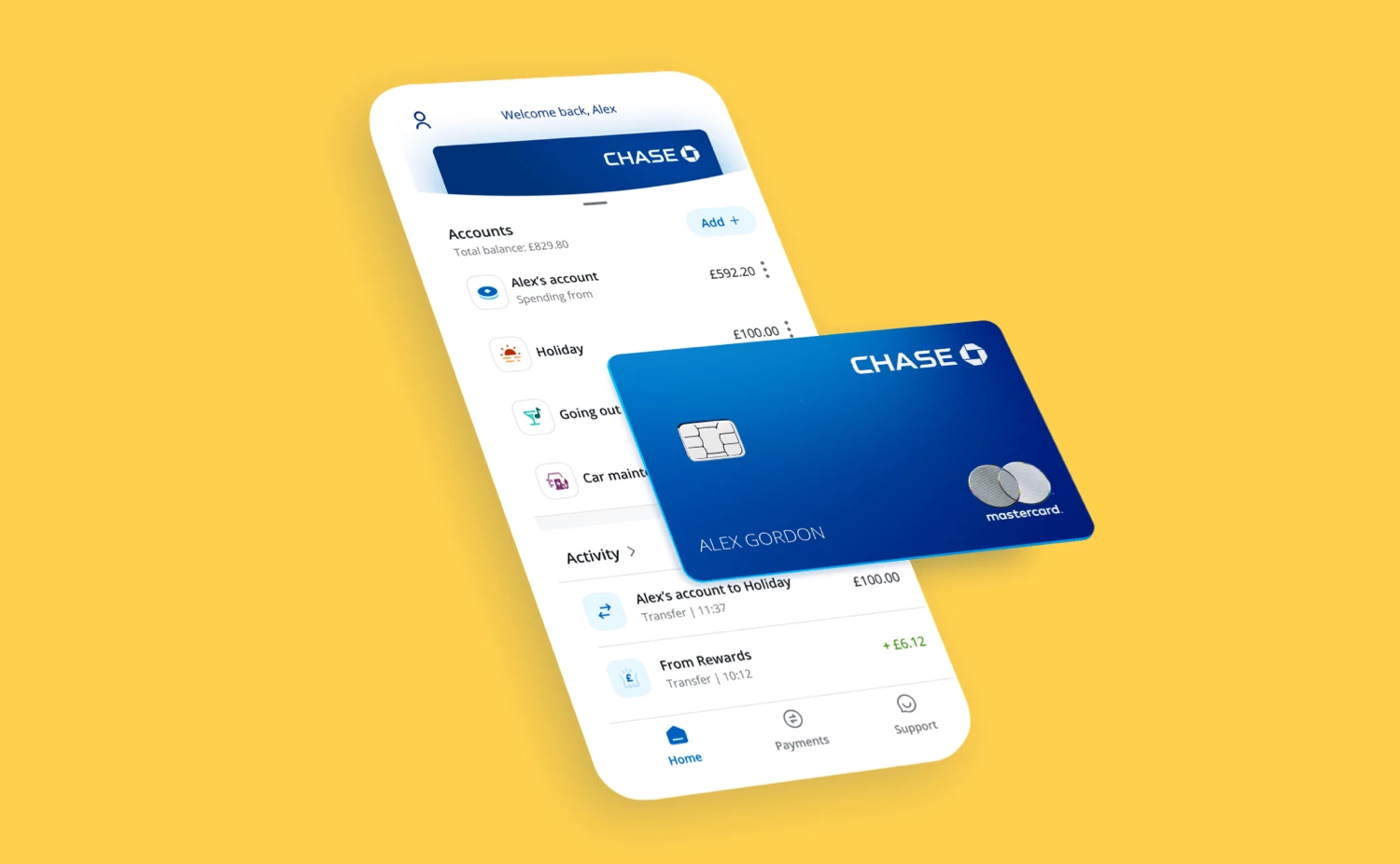

Chase has brought to the UK the kind of rewarding banking you normally only see in the states. We're hoping it starts a revolution on this side of the Atlantic. The digital experience is also first class and there is 24/7 customer support.

Remember to check out the Chase website for all the terms and conditions.