Here is February’s round-up of the top ten accounts in the UK:

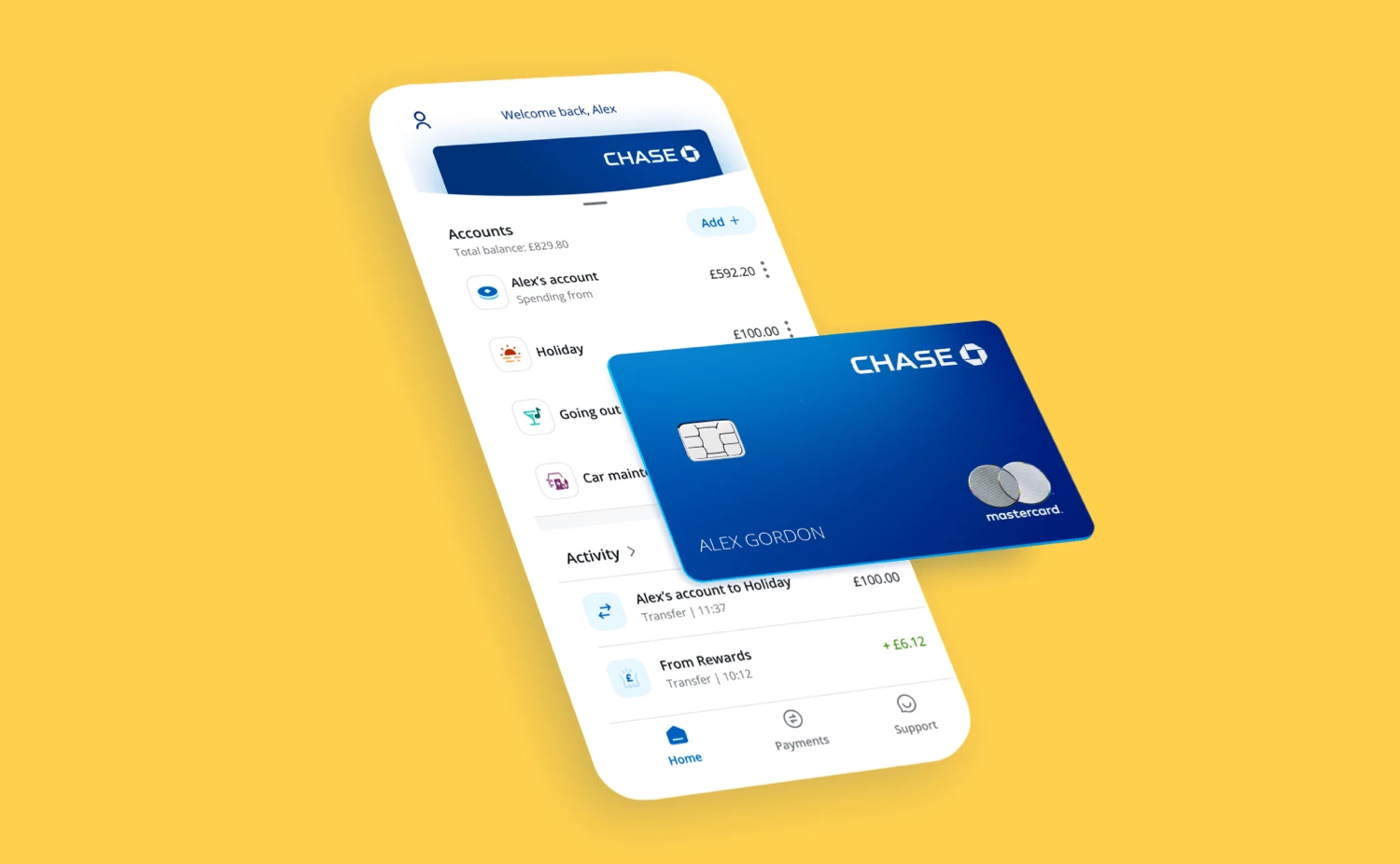

Chase has brought to the UK the kind of rewarding banking you normally only see in the states. We're hoping it starts a revolution on this side of the Atlantic. The digital experience is also first class and there is 24/7 customer support.

Remember to check out the Chase website for all the terms and conditions.

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

With a score of 76% it's clear to see why many people love Starling.

It started a wave of neo-banks in the UK and Monzo remains a top pick due to its plethora of features and desire to constantly innovate.

If you're a traveller or just like having a tonne of nifty features then Revolut is worth checking out.

Some OK rewards make this highstreet bank worth a look.

Halifax is one of the top high-street banks and its Reward Account offers some decent perks (if you meet the requirements to avoid the fee).

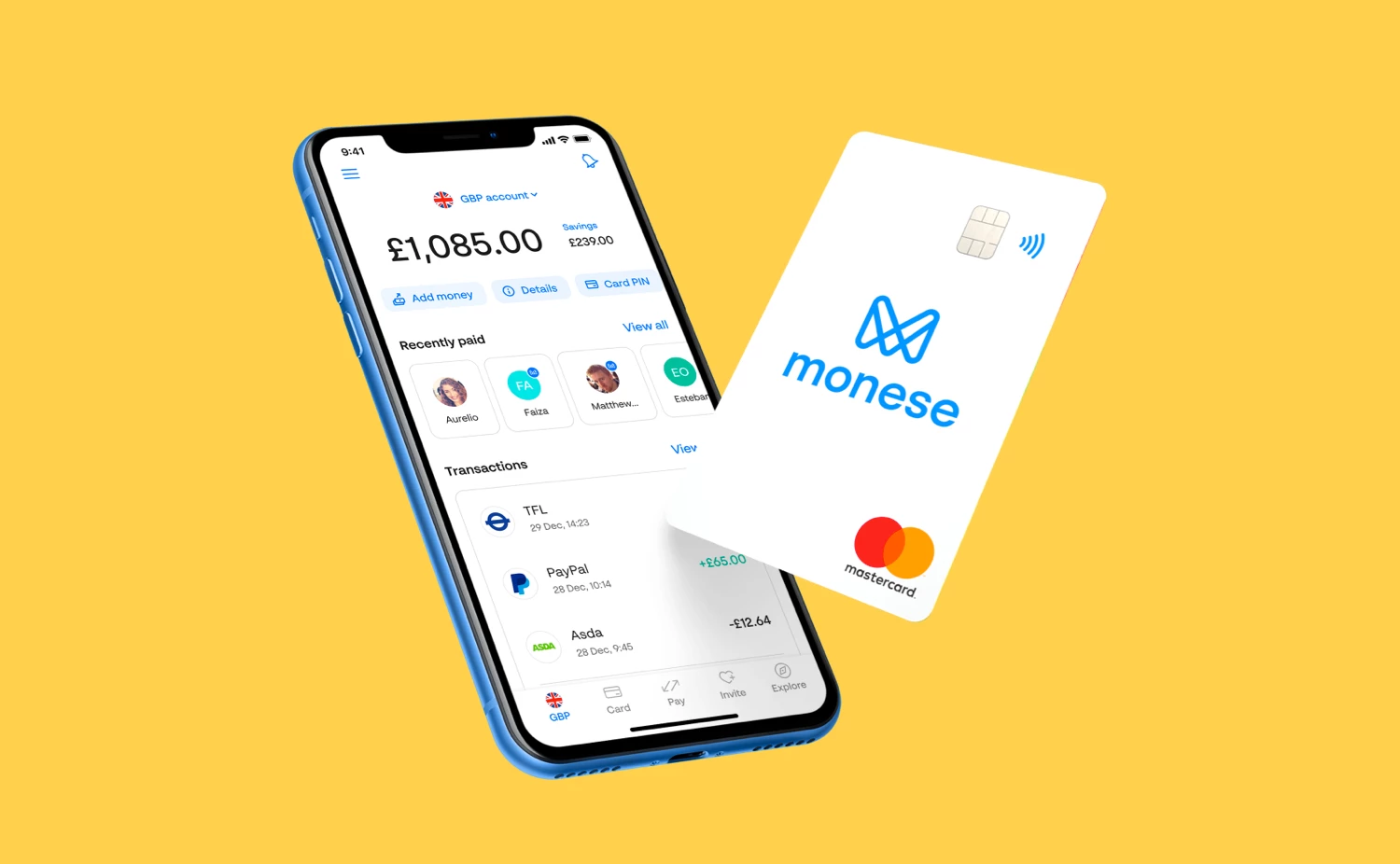

Fantastic for internationals who want a smooth way to open an account, value no/low-fee international spending and want a great digital experience.

Best for those without a great credit score.

A bank account for those having difficulty getting a bank account - and with great customer service to boot.

It’s hard to go too wrong when using this for international transfers, spending abroad or getting paid when in another country.

An oldie, but still a goodie.

Lloyds may not stand out, but it's a dependable bank and its customer service is pretty decent. The £175 switching offer makes it pretty attractive to anyone looking for a new bank.

You will need to switch from another bank (including 2 Direct Debits) and by Thursday 28th March. For full conditions see Lloyds' website.