The Two Minute Review

Nationwide is a grand old building society, but its 5% savings rate on balances up to £1,500 on the FlexDirect account shows it still has some tricks up its sleeve. Consumers are generally pretty happy with Nationwide’s customer service too.

PROS

- 📈 FlexDirect 5% interest rate is the best out there at time of writing.

- 💰 FlexDirect has a 0% overdraft for 12 months.

- 🏦 Lots of branches, though access is restricted on the FlexDirect account.

CONS

- 📱 Old, clunky app.

- ⏰ FlexDirect major benefits only last a year.

Ranked #18 of 25 personal current accounts in the UK.

What The Experts Say

Andy thought regular overdraft users and savers should check out the FlexDirect current account.

What Users Say

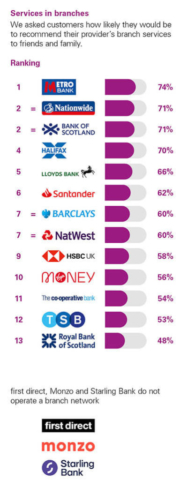

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put Nationwide in position 5.

Click to see the full picture.

1.8/5

Nationwide BS has a Trustpilot rating of 1.8 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 1.75. In terms of organic Trustpilot rating this means Nationwide BS is number 12 out of the 25 personal banks/current accounts we review.

4.3/5

At the last check, Smart Money People had collected 1,613 reviews which gave Nationwide an average score of 4.3 out of 5.

The Deepdive

Nationwide in a Nutshell?

Nationwide was founded in 1846 as the Co-operative Permanent Building Society, and over the years, it has grown through mergers and acquisitions. Today it is the largest building society in the world operating over 700 branches and employing over 18,000 people.

As a “mutual organisation”, Nationwide’s profits are reinvested back into the business or returned to members through better rates or lower fees. This means that Nationwide’s focus is on serving its members rather than generating profits for shareholders.

What Current Accounts Does Nationwide Offer?

Nationwide has a number of current accounts, each with its own features.

FlexDirect

This is Nationwide’s online current account. It gives you limited access to branches, so that you can only use them for:

- Paying in amounts over £300.

- Withdrawing more than £500.

- Stopping a cheque.

- Reporting a card lost or stolen.

The account stands out at the moment because it offers one of the best level of interest of any current account right now with 5% AER paid on balances up to £1,500 for 12 months. Currently this is only beaten by Barclays who are offering an account with 5.12% interest.

In order to qualify you do need to pay in at least £1,000 pounds a month (and this can’t be from another Nationwide account).

Note: You can’t previously have had a FlexDirect to get this offer.

You can also apply for a 0% overdraft on this account (the exact limit will depend on your circumstances but the max is £2,750) which will last for 12 months.

After a year the interest rate on savings goes down to 0.25% AER and any overdraft is charged at 39.9% (variable). This is fairly uncompetitive so we’d say you should only use this account while the headline rates are in play.

There is an extra trick to up the £1,500 limit. If you’re in a couple you can open a joint account, and you can also both open individual accounts. That means you and a partner can save £6,000 across these accounts and it will qualify for the 5% rate.

The FlexDirect account comes with other features too:

- Switch guarantee – you can call Natwest and they can handle the switching of your old current account (including direct debits).

- Apple Pay and Google Pay

FlexAccount

It’s the same as the FlexDirect account except it doesn’t have the 5% interest on your balance and it doesn’t have the free overdraft.

So why would you go for it? Well, it doesn’t have any restrictions on access to branches like FlexDirect does. So the choice is in branch service or better interest.

FlexPlus

This account charges £13 but doesn’t offer the 5% on deposits or free overdraft. It does however offer:

- Worldwide travel and mobile insurance.

- UK and European breakdown cover.

- No transaction fees for using your card abroad.

Student Account

Billed as the UK’s only fee-free student account, it offers an interest-free arranged overdraft of £1,000 in year one, £2,000 in year two and £3,000 in year three.

Things We Like

That 5% interest rate is fantastic.

Nationwide is also a stalwart of British banking and is also protected by the FSCS meaning that in the unlikely event it went bust your deposits would be protected up to £85,000.

Things We Don’t Like

The big draws of this account only last for 12 months – so you’re going to have to switch again in a year if you want to keep earning the maximum interest possible from a current account.

There are fees on non-paid accounts for using your card abroad. You’ll be charged 2.99% for using your card to buy stuff in a foreign currency or for withdrawing cash in a foreign country outside of the UK.

The digital banking experience…

How good is the app and digital banking?

It’s not the best app out there on the market, but it allows you to view your balance, transactions, update your details and make payments and freeze your card. It also has a basic savings goal calculator and you can track your progress as you go.

It also surprised us with some more advanced features. “Impulse Saver” allows you to quickly move money into your savings account. There is also a “round-ups” feature. When switched on it will round up your transactions to the nearest quid and deposit the change into your savings account. So if you bought a magazine for £2.30 it would round it to £3 and put 70p into your savings account.

More advanced features, like bill splitting, are still missing. You also still need a card reader machine to set up a new payee – a pain that other banks and building societies manage to do without.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5/5

Lifetime Customer

After over 20 years with Nationwide, there has never been a poor customer experience. Pleasant staff good service on the telephone, good communication and updates regularly and a nice branch to visit locally.

5/5

Great benefits

A pay monthly current account which gives you breakdown cover, travel and mobile phone insurance. It’s a great deal, had to use the breakdown cover twice and it’s been a smooth process.

5/5

Great benefits for those who like to travel!

I would recommend the Nationwide FlexPlus account which offers unbeatable worldwide travel insurance and European breakdown cover. It is well worth the small charge for having the account.

Critical

2/5

Slow moving, clunky UX, very frustrating security

I’ve used them for many years, and can’t really say there’s much of a difference between them and any other bank other than their security protocols for accessing your bank are much more inconvenient that others I’ve used (they still use a card reader for example). It’s typical slow, frustrating, unhelpful banking that you use only when you must.

1/5

Flex Plus Travel Insurance – seems fine unless you actually need to use it

I’ve been a Nationwide Customer for 20 years and been paying for a Flex Plus Account with travel insurance for ~10 years. Thankfully I’ve never had to use it. Until COVID-19 that is. Nationwide Insurance have made an absolute ordeal out of trying to claim any money back, requesting document after document, reducing the amount I could claim at every turn until I eventually made my peace with getting around £300 back (out of an original £2000 outlay). Now it seems after more wriggling and document requesting, I’m not even getting that. Disgusted with the way I’ve been treated, to say the least.

1/5

Never using them again.

Got recommended to use them ‘because they are a building society’ and well I opened an account. They then offered overdraft and then 3 months later they closed it without any notice putting me under when as a student I receive student finance roughly 3/4 quarters and this about month before I was due to receive the next loan. This has given me a permanent stain on my credit file. I would rather lose a leg than use Nationwide again, they have practical no customer service as their calls are just 30 – 45 minutes of listening to music.

Is Nationwide A Good Bank?

Nationwide is ranked #18 of 25 personal current accounts in the UK (click to see full list).

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.