The Two Minute Review

In its 13 years of existence, Metro Bank has made a name for itself as a “customer first” bank. This attitude has won it an army of devoted customers. The fact it doesn’t charge fees within Europe have also made it popular with tourists. However, its digital features have not kept pace with some of the newer banks and it does not offer rewards to customers.

There’s also an elephant in the room. Last year shareholders had to agree on a rescue package for the bank. We are not saying it is unsafe, but this may give some account holders cause for concern.

PROS

- 😀 Great customer service.

- 🏦 Branches open longer than anyone else.

- 🌎 No transaction or ATM fees in Europe.

CONS

- 📱 App lacking more advanced features such as savings pots and spare change roundups.

What The Experts Say

Finder was impressed by the quality of in branch services and the lack of charges for spending or withdrawing abroad.

What Users Say

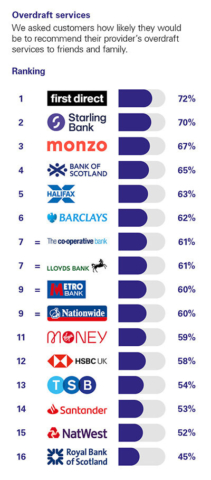

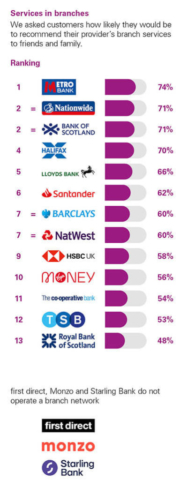

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put Metro Bank in position 4.

Click to see the full picture.

2.6/5

Metro Bank has a Trustpilot rating of 2.6 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 2.38. In terms of organic Trustpilot rating this means Metro Bank is number 4 out of the 25 personal banks/current accounts we review.

4.7/5

At the last check, Smart Money People had collected 2,800 reviews which gave Metro Bank an average score of 4.7 out of 5.

The Deepdive

Metro Bank in a Nutshell?

Metro Bank is a “challenger” bank that was launched in 2010. Unlike other challenger banks, such as Monzo or Starling, it has physical stores. It is the first new high street bank to open in the UK in over 100 years!

Its current accounts are designed to be simple and transparent, with no hidden fees or charges.

One of the key features of Metro Bank is its customer-focused approach. It aims to provide a high level of customer service and convenience, with longer opening hours than most other banks and a focus on in-branch customer service. Metro Bank branches are open 7 days a week, early until late, and offer a range of services, including safe deposit boxes, coin counting machines, and free Wi-Fi.

Its branches have a modern, open-plan design with bright colors, free refreshments, and a dog-friendly policy. The bank also offers instant debit card printing, allowing customers to walk away with a new card on the spot.

Opening A Metro Bank Account

You can open an account in-store or online. You will need:

- To be 11 or over. If you’re aged 11-15 you will have to take your parent/guardian with you to a branch to open the account.

- To be a UK resident.

- To be a UK, EU or Swiss national.

- Have proof of identity.

- Have proof of address.

- If you sign up online you’ll have to take a selfie of yourself to verify your identity.

If you sign up in-store they can actually print your card for you there and then, otherwise, it will take a few days to come through the post. You won’t need an appointment if you open an account in the branch.

What Accounts Does Metro Provide?

Current Account

The main account is, unimaginatively, called “Current Account”. Here are some of the features of the account:

- Free transactions in the UK and in Europe (a rarity and a big selling point of this account).

- Mastercard contactless card.

- Access to branches that are open longer than any other bank (e.g. they’re often open to 6 PM on a Saturday and 5 PM on a Sunday and they don’t close for bank holidays except over Christmas and New Year).

- FSCS Protection means deposits up to £85,000 are protected in the unlikely event the bank goes into administration.

- Award-winning customer service.

- Arranged overdraft and credit facilities.

- Current Account Switch Service means they will switch you from your old bank in 7 days without you needing to handle the closing of your old account or switching of Direct Debits and regular payments.

- Direct Debits facility.

- Optional chequebooks.

- Ability to send money outside the UK.

- Free ATM withdrawals with a limit of £300 a day. You can withdraw £1000 in-store if you are over 16.

It also offers fantastic customer service. This came up as a common thread again and again in user comments. If you lose your card you can talk to them 24/7 and get it frozen (you can also do this through the app).

Cash Account

Metro also offers a “Cash Account” which is a simplified version of the Current Account. It does not offer Direct Debits nor an overdraft. This account is probably only really suitable for children.

Features We Don’t Like

Metro Bank, like a lot of banks, doesn’t pay any interest on the balances you have in your current account. It also doesn’t offer any rewards (such as cashback) or bonuses for being a customer.

How good is the app and internet banking?

The app is straightforward and easy to use. Users on the App Store give it 4.8 and on Google Play Store 4.6 at the time of writing.

That said, it is quite simple compared to rivals such as Monzo or Starling. For example, it doesn’t have a savings pots feature. However, its “insights” tool gives you a basic overview of what and how you are spending. You can also connect accounts you have elsewhere in the Metro Bank app so you have more visibility of your financial life at a glance.

Some Interesting Customer Reviews

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5*

Happy with my bank – almost unbelievable

I have had reason to complain about banks on numerous occasions, Barclays, NatWest, Lloyds, and HSBC.

Opened my Metro accounts just over a year ago and can’t say anything bad about this bank. It has turned out to be everything, high street banks haven’t been, but could and should be.

From opening an account in minutes online, to getting replacement cards in branch in 30mins. Metro has managed to make all the friction of ordinary day to day banking feel seamless.

Being treated like a valued customer in branch shouldn’t come as a pleasant surprise from a bank, but it definitely is with Metro, I have regularly been pleasantly surprised and somewhat relieved to see a new standard being set.

Why on earth more customers don’t switch to or just try Metro (especially since no bank really invests in businesses anymore) is disappointing and appears to be a symptom of preference for convention over convenience.

This convention only encourages the big retail banks Lloyds, Barclays, Nat West’s to continue to be painful and institutionally indifferent to real customer needs.

If you have ever complained about your bank, now you don’t have to, just switch or open an account, support a bank with you in mind.

5*

A good bank account without fees for use abroad

I have been with Metro Bank for years now and I have always had a good experience with them from customer service to the in-store experience. As someone who frequently travels in Europe, the lack of fees has made this account so useful. When I lost my bank card I was able to walk into my local branch and get a replacement within 15mins. Overall – a brilliant high street bank!

5*

Best Bank for many reasons.

Metro Bank is streets ahead of other banks- late opening on Saturdays, first bank to return to normal hours after the first lockdown, & best of all, instant card replacement in branch if yours gets lost, stolen or hacked- the only bank to offer such a service. And the branches are all clean & modern.

Critical

3*

No notifications

I’ve been a MetroBank account holder for several years now and can’t fault them. The fact they print replacement cards there and then in any branch … same with cheque books. Longer opening hours … easy to use app and website

One glaring omission from the app though. Notifications. My HSBC app alerts me the second money is credited or debited and it’s such a useful feature, saves having to log into the app umpteen times a day if you’re waiting for a payment to be made. I was told back in the summer that Notifications would be available in the app in early November …. it’s now 31st December and still waiting! If and when that happens my other bank accounts will be closed and I’ll be moving all my accounts over to MetroBank.

1*

Terrible customer service

I’ve just recently upgraded my phone and as usual I’d forgotten some important security passwords, so with a little forward thinking I requested a magic number to make the transition to my new phone as painless as possible. Having then tried to use said magic number it wasn’t excepted…so then I called the customer service number and was firstly put on hold for 20 minutes and had to listen to some terrible music, and then secondly when I did get through I was told I’d been sent the wrong magic number, and that I had to go into the nearest Metro bank which was a 15 minute drive away…not to mention the £4.50 parking I had to pay for. Fortunately the person I spoke to in store was incredibly helpful and I left with my banking app restored. I’m considering closing my account and trying another high street bank. Yours faithfully Mr disgruntled customer!!

3*

Decent enough, but some data is hidden, and our accounts appear and disappear at random

The app is decent enough, except for two issues:

1) payment references aren’t visible making it more difficult to reconcile incoming payments

2) not all our accounts are always available for viewing and the response from customer services has been variable. On one occasion the agent I spoke to fixed this straight away, I was impressed that the agent answering the phone had the skills and tools available to sort it out. On the other hand, my wife, who is having the same issue has been getting the run-around for a week now and is getting increasingly irate that we can’t see business critical accounts. The web-app is similarly affected. If another agent asks her to uninstall and reinstall the phone-app I may not be restrain her reaction anymore!

Is Metro Bank Safe?

In November 2023, Metro Bank faced challenges related to its financial position and the need to raise funds to strengthen its balance sheet. The bank’s finances were under pressure due to rising interest rates, and it had a significant amount of debt coming due in October 2025. Metro Bank’s shares had experienced a substantial decline since its launch in 2010, and the bank was seeking to raise funds to ensure its ability to continue lending and expanding. Despite these challenges, the bank stated that it was not facing any immediate threat and was operating as normal. Customer deposits up to £85,000 were protected by the Financial Services Compensation Scheme (FSCS), providing a safeguard for depositors in the event of the bank encountering difficulties. The bank’s situation led to concerns among customers and investors, but the FSCS protection offered reassurance for eligible deposits. Since then the situation seems to have stabilised somewhat but it will still be a concern for new account openers.

Metro Bank is ranked #11 of 25 personal current accounts in the UK. (Click to see full list)

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

Chase has brought to the UK the kind of rewarding banking you normally only see in the states. We're hoping it starts a revolution on this side of the Atlantic. The digital experience is also first class and there is 24/7 customer support.

Remember to check out the Chase website for all the terms and conditions.

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.