The Two Minute Review

The Wise Multi-Currency Account has clear strengths for those who travel or have moved to another country. Great rates on international transfers, spending abroad and getting paid when in another country are all solid plus points. Domestically the picture is less good. The ATM fees and the fact you can’t transfer money to your friends who use other banks without incurring a fee are significant drawbacks. We’d advise that most people use this for travelling alongside another account for day to day banking.

PROS

- 🌎 Awesome rates on sending money abroad.

- 😀 Good customer service.

- 💵 Get paid like a local in 10 currencies.

CONS

- 💸 High ATM fees once outside free allowance.

- 📱 App is OK, but could do better.

- 💸 Cannot make free transfers to domestic friends unless they use Wise.

- 📉 No interest on balances.

Ranked #9 of 25 personal current accounts in the UK.

What The Experts Say

4.7*

“The most number of currencies to top-up in and hold among all digital bank” & “Remarkable customer service experience”

“The multi-currency account could be a game changer for your international money.”

4.25*

“Wise (ex-TransferWise) is an excellent money transfer service (9.5/10) and one that the experts at Monito firmly recommend.”

What Users Say

4.5/5

Wise has a Trustpilot rating of 4.5 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 1.85. In terms of organic Trustpilot rating this means Wise is number 11 out of the 25 personal banks/current accounts we review.

While generally positive, we did also see some comments from users on inconsistencies in transfer times.

The Deepdive

Wise in a Nutshell?

Wise (formerly known as TransferWise) is a financial technology company. It was founded in 2011 and now employs 3,300 people and has 10 million customers.

The company aims to make it as easy as possible to move money across borders and even grandly states that they eventually want this to be free.

They made a name for themselves with cheap international transfer rates for customers compared to traditional banks. The use real-time exchange rates to convert your money from one currency to another, which can save you money compared to traditional banks that often charge high exchange rates and fees.

Wise launched its multi-currency current account in 2018.

The Wise Multi-Currency Account

Opening the account:

It’s currently available in the UK as well as the US, Switzerland, most of Europe, Canada, Malaysia, Singapore, New Zealand and Japan.

To get your debit card you first need to sign up for a Wise account and to go through their verification process. For this, you will need proof of ID, a selfie of you with that ID and possibly proof of address. It normally takes about 2 working days to get verified.

You can then log in online and select the option to add a multi-currency account.

Once done you can click on the “Cards” tab and order your card to be delivered. The card will automatically link to your account and all the currencies you have put into it. The delivery will cost £7 in the UK and if you haven’t funded your account you may be asked to do so at this stage before the card can be sent (usually you need £20 in the account to begin with).

What Are The Account Features?

The account is best for those who are dealing with foreign currencies and want to:

- Send/receive money internationally.

- Use their card abroad.

- Withdraw cash abroad.

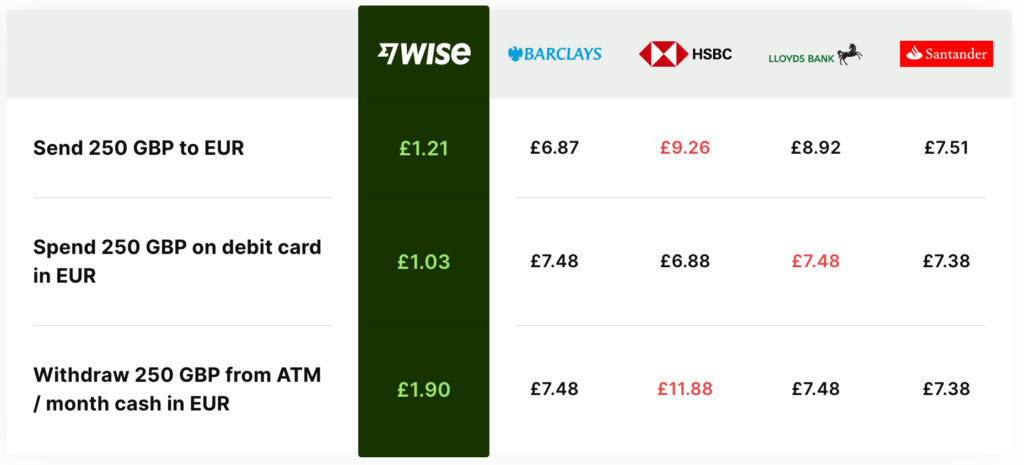

At the time of writing, here is Wise’s own comparison of their fees for these 3 things stacked up against the traditional competition:

This makes it great for those travelling a lot and those who like to shop online internationally and want to avoid paying fees as much as possible.

They also have a “get paid like a local” feature. Essentially you can get local bank details (such as sort code/account number for the UK, IBAN/SWIFT/BIC for Eurozone, routing/account number for US etc) for the following currencies:

- UK

- US dollar

- Euro

- Australian dollar

- New Zealand dollar

- Singapore dollar

- Canadian dollar

- Hungarian forint

- Romanian lei

- Turkish lira

You can therefore use it to get paid in any of these currencies without incurring the usual high fees.

You can also hold and convert money into 53 currencies.

Lastly, in our tests, we were able to talk to contact customer service reps quickly via both the app and telephone.

Is Wise a Bank? Is My Money Safe?

Wise is not classed as a bank under UK law. Instead, it is classed as an “Electronic Money Institution” (EMI). This means it is not part of the Financial Services Compensation Scheme (FSCS) that protects your deposits up to £85,000.

However, as an EMI it is regulated by the Financial Services Authority and subject to the UK safeguarding regulations. This means they have to ring-fence customer funds and hold them in bank accounts of established financial institutions such as Barclays or JP Morgan. This means if Wise went bust most of your money should be available to be returned to you by those trusted banks. However, this might be a slower process than under the FSCS.

Features We Don’t Like

Cash withdrawals from ATMs can incur fees. For example in the UK you get

- 2 free ATM withdrawals a month but further withdrawals are charged 50p per transaction.

- Can withdraw £200 a month for free but after that you have to pay a 1.75% fee and a 50p transaction fee.

We’d say it’s a great card for travelling and internationals – but you might want to hold a second account for some of your day-to-day banking.

Also, no interest is paid on the balance you hold in your accounts. Nor is there an option for an overdraft.

We also couldn’t find a way to do domestic transfers for free, unless the person receiving the funds was also using Wise.

Note: Wise also doesn’t like crypto, so you won’t be allowed to transfer money to a crypto exchange for example. If you want to invest they do have an investing feature available in the UK. It’s a nice add-on, but we’d recommend looking at an Investment ISA (and all your potentially tax-free opportunities) as well as more dedicated trading platforms before you go down this route.

How Good is the App and Digital Banking?

The app is well-designed and good for the fundamentals, but it’s not quite as nifty as other challenger banks.

You can view your balance and transactions and have this broken down by category. Cards can be frozen or cancelled. Additionally, you can also set aside savings pots and give them a custom name e.g. “Holiday fund”.

However, you cannot set savings goals and more advanced features like “roundups” and “split the bill” are missing.

Note: You can also use your card with Apple Pay and Google Pay.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5*

Massive saving over banks

If you want to transfer money abroad into another currency, this app is is a huge saving over bank rates and far quicker too as banks take days. I’ve used it a few times and it’s easy to set up and use and so convenient being able to do this on your iPhone.

If you transfer from your bank account to TransferWise (they give you the details as you complete your transfer) it will save you the usage fee that say Apple Pay charges moving the money from your bank to TransferWise. That said Apple Pay charged less than £1.50 on a £700 transfer.

My only complaint is that you don’t seem to be able to choose the final transfer amount the recipient receives to include all charges (eg Apple Pay). It works as expected for TransferWise charges, but not for the third party charges. I had to fiddle with my send amount in an attempt to make sure the recipient received the full amount requested. In the end I failed, but only by a few pence. However that could be the difference between a happy and unhappy recipient or a feeling you sent more than was required.

5*

Great app!

I had to send quite a large amount to my son and usually used Paypal so I was quite sceptical about using Transferwise as my son was telling me it was a better rate. I was so scared. I put in his details and when I got to the part when I had to go to my bank to arrange transfer to them separately rather than my son I took a panic attack and cancelled!! The next day I decided after research, to try again and I downloaded the app. I still had to do my bit from here separately but understand it was because my bank wasn’t on their list. The money was taken from my account this end but as it was Friday the weekend meant a delay till Monday so in effect me cancelling put him under pressure because he was moving on Tuesday. However the great thing about the app was I could check every step! Down to every minute “It will arrive in 23 minutes “ then 9 minutes then 2 minutes! It was quite miraculous they had the completion down to the last minute!! Wholly recommended!!

5*

Absolutely amazing.

This is a great app and Wise is a fantastic company.

I’ve been using their services to send money abroad for around five years. I’ve never encountered any problems or issues, very easy to use, very easy to set up new recipients and currencies, everything is straightforward, easy to set up or change payments, the communication is excellent throughout transactions, I could just keep going on with the list.

It is also incredibly fast and cheap to send money to abroad. With my bank it used to take around 4-5 working days for the money to arrive on the other end and each transaction cost me £9.00. With Wise it takes only a mere second and the fee they charging is ridiculously low, usually cost around £1. That was actually the reason why I gave them a go. I’ve came across their advert in social media, read the reviews and decided to give them a chance.

I’ve never regretted it.

So to the good people who read my review, go ahead download the app and start save money and time on transfers to abroad.

Critical

1*

They froze my account over £15K with no reason for three months now. They provide no reason and no release date. They don’t answer our emails. They don’t set a date. Their attitude is if you’re not happy take legal actions. They are abusing people’s trust.

Is Wise’s Account Any Good?

Wise is ranked #9 of 25 personal current accounts in the UK (click to see full list).

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.