The Two Minute Review

Monzo is probably the most famous challenger bank and with good reason. Customers love its hot coral card, app experience and constant innovation. It’s just such a shame Monzo don’t offer rewards.

PROS

- 📱 Best in class mobile app and digital experience.

- 🙂 Quick and easy to sign up.

- 🌎 Fee free international transactions.

- 😃 Great benefits with Plus and Premium accounts.

CONS

- 🏦 No branches and no in-app cheque deposits.

- 💸 Other banks offer you rewards or switching bonuses.

Ranked #4 of 25 personal current accounts in the UK.

What The Experts Say

4.7*

“Smoothest app and user experience.”

4.8*

“in many respects they are leading the challenger bank charge.”

“Monzo offers a great app-only banking experience and is a worthy contender amongst challenger banks.”

What Users Say

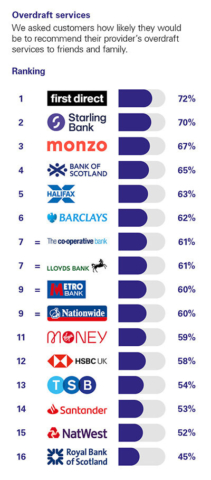

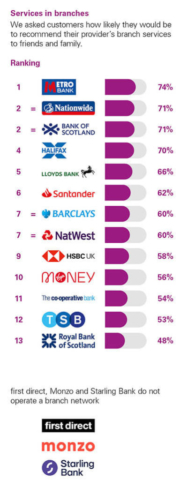

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put Monzo at the top.

Click to see the full picture.

4.4/5

Monzo has a Trustpilot rating of 4.4 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 2.34. In terms of organic Trustpilot rating this means Monzo is number 5 out of the 25 personal banks/current accounts we review.

4.9/5

At the last check, Smart Money People had collected 8,798 reviews which gave Monzo an average score of 4.9 out of 5.

Overall consumers like the hassle-free approach to banking, the great app and customer support. The things consumers complain about the most are getting locked out of their accounts and delays in the signup process. However, these are in the minority.

The Deepdive

Monzo in a Nutshell?

Monzo is probably the most famous challenger bank in the UK. It was launched in 2015 and is headquartered in London. Over that time it has got pretty big. It now employs 1,600 people and has 5.5 million customers (with over £3 billion deposited in its accounts). It also won the Best British Bank award at the British Bank Awards this year – an award previously held by Starling.

Monzo is regulated by the FCA (Financial Conduct Authority) and PRA (Prudential Regulation Authority). It is also registered with the FSCS (Financial Services Compensation Scheme) meaning your deposits are protected up to £85,000.

What Accounts does Monzo Offer?

Monzo has 3 accounts. One is a free current account, the others are Monzo Plus and Premium (explained below). They also have a free teenage account for 16-17-year-olds that blocks things that are illegal for teenagers such as gambling. They also offer joint accounts which have individual cards and joint budgeting tools.

Monzo Free Current Account

This is a UK current account with a sort code and account number like you would get with any other bank. You also get a Mastercard debit card (usually in their signature eye-catching coral colour).

Other features include:

- Customer support through the app.

- Bill splitting feature.

- Overdraft facility – Monzo will do a soft credit check when you sign up (this does not affect your credit score). Depending on this you can apply for up to £2,000 charged at either 19%, 29% or 39% APR.

- Ability to apply for personal loans of up to £25,000 through the app (again dependent on your credit score).

- Monzo flex (explained below).

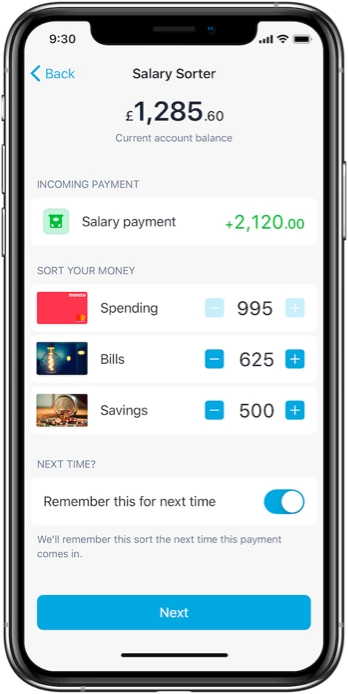

- Savings pots and “Salary Sorter” (explained below).

- Fantastic spend categorisation and analysis.

- Fee-free international spending via your Monzo card. They use Masterdard’s exchange rate too which is close to the real mid-market exchange rate meaning they do not profit from inflated exchange rates as some other banks do.

- Fee-free cash point withdrawal within European Economic Area. £200 free withdrawal every 30 days elsewhere (3% charge after that).

Savings pots are like mini separate accounts where you can deposit money. These savings pots can be called things like “car”, “holiday” etc and can be given unique images within the app. You can have up to 20 of these pots. You can also turn on a “round up” feature within your main account. This means that whenever you buy something, Monzo will round it up to the nearest pound and put the difference into your nominated saving pot. For example, if you had this feature switched on and you bought a coffee for £3.40, Monzo would round this to £4 and put 60p into your savings pot. You can also lock the pots so you can avoid the temptation to remove them.

Mozno is also offering 3% interest on savings pots – this is paid monthly. You can still access and withdraw your savings at any time.

So what is the salary sorter? This feature allows you to split your wages across your main spending account and different pots as it is coming up. Monzo can then remember this for next time. You can also use this salary sorter feature to get your wage a day early with no interest or fees.

What is Monzo Flex? It’s a BNPL (buy now, pay later) feature that Monzo has introduced to rival credit cards and other BNPL providers such as Klarna. If you’re eligible you get a virtual “Flex Card” on your phone which you can use to spread the cost of most purchases over 3 months at no cost. You can use this in shops or online. You can also pick any transaction from the last two weeks in the app and decide to “flex it”. You can also extend it to 6 or 9 months but will pay an APR of 24% (variable).

Monzo Plus Account

This costs £5 a month and you must sign up for it for at least 3 months. With this you get all the free Monzo featured plus:

- The ability to add external accounts and credit cards so you can track spending across them within the Monzo app.

- A holographic Mastercard.

- Earn 1% interest on your main balance and savings pots up to a total maximum of £2000.

- Ability to create virtual debit cards. Great if you often lose your card and have to update Netflix etc.

- Credit score tracker and analytics.

- Exclusive offers – e.g. 15% off Patch plants or RAC cover from £4.75 a month.

- Export your transactions to Google Sheets.

- A free physical cash deposit a month (usually costs £1).

- More control over roundups.

- Fee-free cash point withdrawal within European Economic Area. £400 free withdrawal every 30 days elsewhere (3% charge after that).

Monzo Premium Account

This costs £15 a month and you must sign up to it for at least 3 months. With this you get all the free and Monzo plus features plus:

- An exclusive metal card.

- Phone insurance.

- Worldwide travel insurance.

- Earn 1.5% interest on your main balance and savings pots up to a total maximum of £2000.

- Discounted airport lounge access.

- Fee-free cash point withdrawal within European Economic Area. £600 free withdrawal every 30 days elsewhere (3% charge after that).

- 5 free physical cash deposits a month (usually costs £1).

Cash Deposits

If you find yourself having to physically put in cash you can do this via 28,000 PayPoint locations. The deposits must be between £5 and £300 and you’ll be charged a quid for each deposit.

ATM Transaction Fees

This can be a bit complicated with Monzo, but we’ve done our best to break them down below:

Withdrawals within the UK and EEA.

- Free for Plus and Premium users (there is a limit of £400 a day and a monthly limit of £5,500).

- For standard accounts, you can withdraw £250 every 30 days (after that you get a 3% fee).

If you use Monzo as more of a bank you might get notified in the app that your limits are higher (the qualification criteria are here).

Withdrawals outside the UK and EEA.

Free for Standard, Plus and Premium up to £200, £400 and £600 and then a 3% fee when you go beyond this.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5*

Amazing customer services. The help I got from Monzo every time I have raised an issue is indeed of 5 starts. I have raised a dispute with the bank since the company charging me unfairly could not be reported at all in UK. However, with the dispute I got through Monzo the agents were super duper cool and nice! And yep, fast in answering all the queries I had over 6 months. Thanks Monzo team.This is an amazing financial model.

5*

Great for everyday use and saving

I love Monzo it keeps me in control of my money. I could never save money before but because of its little pots and penny challenges, also the round ups when shopping for every day essentials I’m always saving without realising

5*

Not sure why negative reviews. I’ve been using Monzo for over a now and no issues whatsoever. Everything straight forward. I have also taken a loan to pay off my car, did all via the app and its all clearly displayed including outstanding balance. So far so good.

Critical

1*

I had monzo for 3 years never had any problems, yesterday they closed my 3 year account without explanations my money is in the transfer process for 2 to 4 weeks, total disappointment, I did not expect this from monzo. No explanation from monzo, why they closed my account, they just closed and locked my money, disappointing, horrible.

1*

Tried opening an account by going through all the steps on their app – 2 days later (their app says it takes between 5 minutes to 48 hours to approve) still no account, meanwhile my girlfriend tries and is instantly approved.

Emailed Monzo support and they say it could are 28 days for it to process – now, who waits a month to open an account? Told them to close my application and I’d go elsewhere (Starling bank, much quicker process and got approved right away) – 4 days later I have an email from their staff asking me for personal information (passport, drivers licence etc, which I’m not going to do via email) but again, I told them I no longer wanted the account opened as I’d gone elsewhere (Starling) and to stop the process.

They emailed back saying they’d need my personal documents before they could cancel my request – again, not happening! 5 minutes later I checked the monzo app to see if they’d listened, and my request was actually rejected – not sure why they couldn’t have just approved the account in the first place if it was that easy…

…used the exact same information to open a Starling account and was approved almost immediately.

Long story short, just go with Starling, which is pretty much the same thing (better for travelling too) with a much quicker time frame.

1*

Monzo bank closed my account without notice or explanation.

I am disappointed with the service I am receiving from Monzo bank. I feel that my emails have been ignored and passed to one another for a long time, creating confusion and uncertainty. I expect an E-bank to at least respond to the customer’s email correctly and give online support.

For the last two months, I have been asking this regularly and am still waiting for a response. I trusted Monzo bank with my entire business. I am struggling and requesting the essential services from the bank, which is a bank statement starting from when the beginning of the transaction AND a letter confirming that my account is being closed down.

I trusted Monzo bank with my entire business. I am struggling and requesting the essential services from the bank, which is a bank statement starting from when the beginning of the transaction AND a letter confirming that my account is being closed down.

Just go with Starling, which is pretty much the same thing (better for travelling too) with a much quicker time frame.

Disappointed client.

Is Monzo A Good Bank?

Monzo is ranked #4 of 25 personal current accounts in the UK. (Click to see full list)

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.