The Two Minute Review

First Direct is an excellent bank. It might not have all the digital features of the more up and coming challenger banks, but if offers a seamleess digital experience and the £250 interest free overdraft is super handy. We do however miss their £175 which they ran for most of last year. We’d be tempted to wait to see if they bring it back before switching.

PROS

- 📈£250 overdraft is very useful.

- 😀 Award winning customer service.

CONS

- 🏦 No branches.

- 📉 No interest on the balance in your account.

What The Experts Say

“The first direct Current Account offers a great range of benefits, both financial and insurance-based.”

“In our latest customer experience ratings – published in spring 2022 – the 1st Account is awarded 74.15%. Overall, it is rated the 4th best current account for customer experience and wins a gold ribbon.”

What Users Say

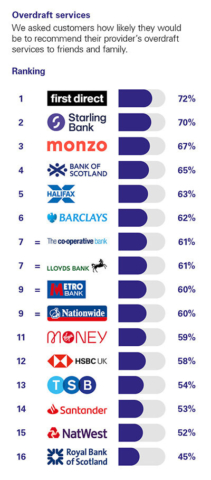

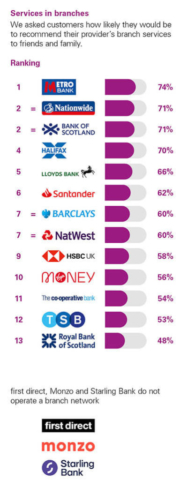

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put First Direct in third position, just short of challenger brands Monzo and Starling. Their £250 free overdraft won them top spot in this category.

Click to see the full picture.

4.2/5

First Direct has a Trustpilot rating of 4.2 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 2.65. In terms of organic Trustpilot rating this means First Direct is number 1 out of the 25 personal banks/current accounts we review.

4.7/5

At the last check, Smart Money People had collected 865 reviews which gave First Direct bank an average score of 4.7 out of 5.

The Deepdive

First Direct in a Nutshell?

First Direct is an online and telephone-only bank (no branches). It has 1.45 million customers in the UK and is owned by HSBC. While not as new as challenger banks such as Starling and Monzo (it was actually set up in 1989), it is trying to disrupt the traditional high street banks.

Sign Up and Switching Process

So First Direct have a pretty juicy switching offer on their “1st Account” (we go into more detail below), but is this a bit of a hassle?

Well, sign-up is pretty straightforward. It’ll take about 10 minutes and you can do it through their apps or your browser. There are a few requirements, however:

- You’re over 18.

- Live in the UK.

- Haven’t been made bankrupt or registered for an IVA in the last 6 years.

They’ll ask you about where you’ve lived for the last 3 years, your job and how much you earn and your number of dependents. They’ll also ask for valid ID which includes:

- Driving licence.

- Passport.

- National EEA / Swiss ID card.

You will be asked to take a selfie to check you are the person on your ID and they’ll check your credit score.

Once done you just have to wait for approval which is usually quite speedy – turnaround within a day is fairly standard.

When it comes to switching, you can get First Direct to do all the hard work. If you give them a call when you open the account (or request it as part of the online application process) they will contact your old bank and shut it down. They will set up all your regular payments for you on your new account and, as they put it:

We tell all your Direct Debit originators you’ve moved banks and give them your new details, including your employer so your salary can be redirected.

What Do You Get With The Account?

A £250 interest-free overdraft: Another stand-out feature is the long-term £250 free overdraft facility. Go above this limit and it costs a heft 39.9%, but if you regularly dip into your overdraft each month this could be a real plus.

FSCS protection: You’re insured for up to £85,000

Awesome customer support: It may not have branches, but the phone and online support of First Direct recently topped Martin Lewis’ poll and won a Gold Ribbon from The Times.

You also get a Mastercard debit card that looks pretty classy in all black.

Are There Any Fees?

We wouldn’t recommend this as the best card for travelling because it has a:

- A 2.75% fee for all foreign transactions, including cash withdrawals (this is on top of the Visa/Mastercard exchange rate).

- A further 2% on top of this for withdrawing from ATMs abroad (minimum £1.75, maximum £5.00).

What Are The Savings Rates Like?

First Direct doesn’t pay any interest on any balance you keep in the 1st Account. However, you do get access to their 12-month savings account which pays 7% AER. Note this is not easy to access so you will have to keep your money in there for a year and you can only ut money in at a rate of between £25 and £300 a month.

What’s The App Like?

We think that for an online-only bank, First Direct’s app is a little disappointing. It covers the basics well and you can freeze your card, transfer money, tag up transactions as “car” etc and see generally how much you’ve spent.

However, some of the challenger banks are making it look in need of a refresh. It doesn’t give you the ability to view your card details and pin, set up savings pots, set budgets, split bills, get detailed spending insights or quickly share your bank details. Annoyingly, you can only look back at 6 months of transactions.

Some Useful User Reviews

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5*

Brilliant

Brilliant… we just need one or two ‘extras’. I’ve been with First Direct for just a few years now, but I have been aware of them since I think the late 1980’s. And I wish I would have moved my banking with them sooner. The customer service (if I’ve ever needed an advisor, which has only been twice), is excellent. Nothing is too much trouble for them. If they can sort it for you over the phone, they will, and quickly. But they don’t rush you. They make time for you, and if they say they will phone you back, they will! There’s still one or two things I’d like to see within the app, which seemingly has been on the cards for quite some time. Transaction alerts, when money arrives in your account, or money over a certain amount (a figure we could set ourselves) goes out. Otherwise, I’m very happy with the banking service I receive from them. Keep up the good work.

5*

First Direct are the best!

I have been with many different banks over the years, including Monzo and Starling, but for me there is only one that has consistently impressed: first direct! The mobile banking app is so easy to use and I love the fact that I can see pending payments and credits all on the same screen! Whenever I’ve needed to phone first direct, the staff have always been polite, professional and highly knowledgable. Not to mention the fact that my call is answered within a few rings! I never got that with Barclays, Lloyds, NatWest and the TSB! It’s also really comforting and reassuring to know that I can phone first direct 24 7 365, what incredible customer service!!! first direct are also exceptionally reliable digitally too, unlike most of the competition where outages happen far too frequently! It’s a real pleasure to discover a bank that is so refreshingly different from the rest: well done first direct, you are the best!!!

5*

Fabulous bank

Fabulous bank. I have been banking with them for for over 20 years. Telephone service brilliant you get through to a person immediately. FD staff are fry and always help you. The banking App is excellent. Parent company HSBC should do things the FD way. If FD changes to be like HSBC I would close my account!

Critical

3*

Customer services is good until something goes wrong

Customer services is good until something goes wrong. We have been with them many years and commenced ISA’s a few years ago, only for them to reduce their rate when they had sufficient transfers in from other providers. I then had the hassle of finding another provider which I did as FD rate wasn’t competitive.

We still have the regular savings plan with them, but recently I have been in bed not well. I missed the deadline by a few hours to transfer the regular amount from our current account to our savings account, so they charged us £5 for a few hours when in effect they moved the cash from account to another. We have had this renewable 12 month account for many years putting the cash in long before its due without interest, but then get charged £5 for a few hours, and they didn’t want to know.

They are happy to pay a new customer £50 or whatever their current bribe is, rather than not charge a long standing customer £5. We have one more month to pay on the savings account then we will close all accounts with them, not to mention the fact that they are reducing this account from 5% to 2.75%, which of course is only calculated on what you have in the account each month, and go to a provider who appreciates long standing customers.

1*

Was once the best, but no longer

First time I’ve had to contact FD for 3 or 4 years and was previously double impressed. But my recent experience was extremely disappointing, standards well below expectations. FD have taken on board the COVID excuse for delivering poor availability hours, long waiting times and a casual attitude towards service delivery.

2*

Unnecessary set up requirements

Why is it so complicated to set up the App on a new phone? I appreciate security but having to set up all new security keys and passwords and security questions 1, 2 and 3 is a nightmare. They will never be recalled!

Is First Direct A Good Bank?

First Direct is ranked #1 of 25 personal current accounts in the UK. (Click to see our top 10)

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.