The Two Minute Review

Santander is a huge bank with a long standing reputation. Beyond that, it’s quite hard to get excited about their products – though its new “Edge” account is a step in the right direction. If you want a big bank with a straightforward but basic app then Santander is fine.

PROS

- Very established bank.

- The new “Edge” account has up to £17 rewards a month.

CONS

- Basic banking app.

- Customer service is middling.

- 1|2|3 accounts are not groundbreaking.

Ranked #13 of 25 personal current accounts in the UK.

What The Experts Say

On the 123 Current Account: “Using the Santander 123 Current Account as your main account for bills and your wages will allow you to benefit from earning cashback and interest. Despite the poor reviews, there are satisfied customers out there.”

What Users Say

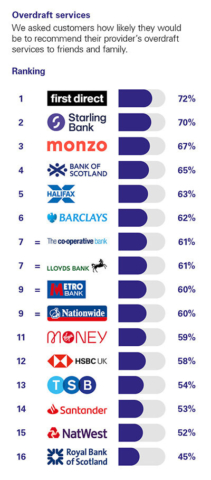

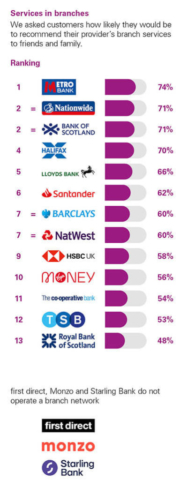

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put Santander in 11th position.

Click to see the full picture.

1.3/5

Santander has a Trustpilot rating of 1.4 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 1.28. In terms of organic Trustpilot rating this means Santander is number 23 out of the 25 personal banks/current accounts we review.

3.9/5

At the last check, Smart Money People had collected 1,785 reviews which gave Santander an average score of 3.9 out of 5.

The Deepdive

Santander in a Nutshell?

Santander is a global banking group based in Spain that offers a range of financial products and services to individuals, businesses, and corporate clients. The company was founded in 1857 in Santander, Spain, and has since grown to become one of the largest banks in the world.

In the UK, Santander is one of the “big 5” banks with 20,000 staff, 444 branches and over 14 million customers.

Opening a Santander Account

You can apply online or in a branch. You will need to be a UK resident and over 18 and be able to provide a valid form of ID (driving licence, passport etc). You will also need the following details:

- Valid email address and phone number.

- Address history for the last 3 years.

- Your job start date (not required for student accounts).

- Yearly income and expenditure.

The whole application should take about 10 minutes and you should get approved in a day or so.

If you’re switching from another bank you can also use the switch guarantee service meaning you will automatically have your old account closed and moved over to Santander. All Direct Debits and regular payments should also be moved for you also.

What Accounts Do They Offer?

Everyday Current Account

This is Santander’s standard account. It’s free to use, but you don’t get any interest on your balance and it doesn’t come with any great benefits – though it does have a couple of nice features. One of these is cashback offers for retailers. You get up to 15% off at the likes of Costa and Just Eat – usually offered on a time-limited basis. You can view these offers in the app and choose to opt-in or not.

You also have the option to apply for an overdraft.

1|2|3 Current Account

This is Santander’s premium account. This account doesn’t come for free, but it does offer some key perks:

| Monthly Fee | £4 |

| Interest | Monthly interest of 2.0% AER on balances up to £20,000 |

| Cashback (up to a max of £5 in each tier monthly) | 1% on Council Tax, phone, mobile, TV and broadband and Santander mortgage payments |

| 2% on gas and electricity | |

| 3% on water bills | |

| Requirements | Pay in £500 a month |

| Set up two Direct Debits on your account |

Like with the basic account, you also get access to cashback offers with certain retailers.

So is the account worth it? Well, that depends on your personal circumstances. Here is a typical example of household bills and the cashback you would get:

| Bill | Tier | Cashback Rate | Cashback |

| Council Tax | £150 | 1% | £1.50 |

| Mobile Phone | £40 | 1% | £0.40 |

| Broadband | £35 | 1% | £0.35 |

| Gas | £70 | 2% | £1.40 |

| Electricity | £60 | 2% | £1.20 |

| Water | £40 | 3% | £1.20 |

| Total | – | £6.05 |

So in the example above you would get £6.05 of benefits. However, as the account costs £4 a month it would only be worth £2.05 to you overall.

Occasionally, Santander will vary rates, e.g. energy will go to 4% in September and October this year, but overall we don’t think it provides exceptional value unless you are a Santander mortgage customer.

You should also note that not all providers are eligible for cashback. For example, GiffGaff isn’t listed as an eligible mobile phone network. You can check if your providers are listed here.

Santander Edge Current Account

This is a new offering from Santander that gives you different levels of cashback. It costs £3 a month and you need to pay in £500 a month and have two active Direct Debits. In return get:

- 1% cashback on household bills. This consists of council, phone, broadband, gas, electricity and water bills.

- 1% cashback on “essential spend”. This consists of supermarket spending, fuel/electric vehicle charging and travel tickets (limited to train and bus).

You can get £10 cashback on each of these categories of spending. Once you deduct the £3, you can make £17 from this account.

You also get access to a 4% AER easy-access savings account for balances up to £4,000.

Features We Like

The cashback offers are interesting. The Edge Current account shows that Santander is looking to take on Chase bank’s groundbreaking cashback offers in a war to attract new customers in the UK.

Features We Don’t Like

Foreign transaction fees are not too competitive. You will be charged a 2.75% transaction fee when buying in a foreign currency plus a £1.25 non-sterling purchase fee. For this reason, we wouldn’t recommend Santander for travel.

How Good is the App and Digital Banking?

It is fine for the basics, but not much more. It has a clean design and will give you full access to your balance and transactions. You can make payments, transfer money and do other basics such as setting up standing orders. Cashback offers can also be accessed through the app.

However, if you want a breakdown of your spending you have to download a separate app – My Money Manager. Even this clunky workaround is not as good as the features challenger banks such as Monzo or Starling load into their apps natively.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5*

Excellent online banking!

I honestly believe Santander has one of the best and most flexible Web and App banking systems. Security checks have been a bit OTT recently but that is understandable and reassuring given the amount of scams currently about!

5*

Cashback Account

I love my Santander 123 account because you get cashback each month on services and purchases. I also like that I can monitor the account via the App. Santander are also very efficient at letting you know if any suspicious activity on account.

5*

Fair and caring

Santander Bank is fair and caring with customers, my oldest bank. I have had great experience with them with financial support, credit card facilities. Their banking app is good, guiding customers against online fraud. I have enjoyed banking with them, helpful.

Critical

3*

Getting impossible waiting times to contact

I have banked with Santander quite happily for several decades from when it used to be Alliance and Leicester, always had good customer service by telephone. I know there is chaos now with the Ukraine war and the past two covid years but really trying to contact them by phone has become so bad in the last few weeks – I have just waited for 46 minutes before giving up – to deal with a transaction I couldn’t make yesterday as they wanted me to check payee details – for that conversation I waited 23 minutes. I will have to try again tomorrow., am now dreading it. As other reviewers have said – get more staff! This is unacceptable. If it continues I will be changing my bank.

2*

Beaurocratic, slow, old school

Santander have a big issue when it comes to UI/UX. They lag behind competitors when it comes to mobile banking.

Their structuring of what should be simple accounts is sub-par. Their approach to digital is archaic. Staff are consistently uninformed of products and procedures. Over reliance on forms and paperwork is off putting in dealing with them.

Is Santander A Good Bank?

Santander is ranked #13 of 25 personal current accounts in the UK (click to see full list).

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.