The Two Minute Review

Revolut has the most innovative current accounts out there. It was actually hard in writing this review to cover all the features. Great exchange rates, a brilliant app experience and the ability to buy crypto and shares are the standout features. Early salary payment, savings vaults and various insurances on premium accounts are just some of the others. However, for all these cool features if you have a problem you won’t be able to speak to a person.

PROS

- ✈️ Fantastic travel rates.

- 📈 Ability to buy shares and crypto.

- 📱 Loads of features in the app from budgeting to bill splitting.

- 💰 Get your salary a day early.

CONS

- 🏦 No branches or telephone support.

- 💸 Can be difficult to understand all the fees and you’ll probs have to pay for a premium account to totally avoid them (though this can still represent very good value).

- 📜 Not a bank but an “e-money institution” meaning don’t get FSCS protection, though Revolut is required to ring-fence your deposits.

Ranked #5 of 25 personal current accounts in the UK.

What The Experts Say

4.4/5

Broker Chooser gave Revolut a 5 for ease of opening the account, but only a 1.8 for customer service overall saying that “it is sometimes hard to get the relevant answers.”

4.7/5

“Revolut is bringing about positive change that allows you to avoid all the cumbersome and bureaucratic bottlenecks of conventional banking.”

“Revolut is a modern, convenient way to manage money from an app…However, we think it a good idea to avoid keeping all your eggs in one basket. Hold on to your high street bank account and use Revolut as an every day account.”

What Users Say

4.4/5

Revolut has a Trustpilot rating of 4.4 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 1.85. In terms of organic Trustpilot rating this means Revolut is number 10 out of the 25 current accounts we review.

4.9/5

At the last check, Smart Money People had collected 8,153 reviews which gave Revolut an average score of 4.9 out of 5.

The Deepdive

Revolut in a Nutshell?

Revolut was founded in 2015 and since then has expanded to 5,000 employees internationally and, as of November 2022, it hit 25 million customers worldwide. It was Company of the Year at the 2020 UK Tech Awards and has raised over $1.5 billion in funding.

Revolut is also totally digital, not having any physical bricks and mortar location on the high street. All customer service is done through their app barring an automated line to report your card lost.

Is Revolut a Bank?

Well, no. As of 2023 do not have a banking licence in the UK. However, they can operate because they have a banking licence given to the by the European Central Bank (though this again, weirdly, doesn’t make them a bank).

The company says that it does plan to apply for a licence in all jurisdictions they operate and in March 2023 it announced that it was at “the finish line” of winning a UK baking licence. However, at the time of writing, they do not have a licence.

Is My Money Protected?

Through banks you are protected via the FSCS (Financial Services Compensation Scheme) which protects deposits up to £85,000. As Revolut is not a bank and therefore not part of this scheme you do not get that protection.

However, legally Revolut is an “e-money institution” and therefore is subject to safeguarding laws about how it must handle your money as well as being regulated by the Financial Conduct Authority. This means that once you give Revolut your money it has to place this into a dedicated “safeguarding account” (held by the likes of Barclays) and ring-fenced it for you. This means in the event of Revolut going bust there should be enough money to pay customers what they are owed. The difference with the FSCS scheme is that is independently guaranteed whereas e-money institutions guarantee the money themselves. It may also take longer to get your money back.

You should note that any money you put in a Revolut Savings Vault or any cryptocurrency or commodities you have bought through the Revolut app will not be protected.

So with the whole bank/non-bank debate covered, let’s look at the features of Revolut accounts.

Opening a Revolut Account

As you would expect, the application process is done through their app. After verifying your telephone number you will be asked for your name, date of birth and email account. You will then have to make an initial deposit from another bank account you own. Once done you will need to verify your identity (UK passport, driving licence or foreign passport with visa).

Usually, the account can be verified and set up in 5 minutes. Your card can take about a week to come out to you, but you can have a virtual card that will work with Apple Pay and Google Pay right away.

Account Features

Revolut is perhaps the most innovative on the market. It’s got a beautifully designed app with awesome everyday features such as budgeting tools and bill splitting. On top of this, it’s excellent for spending or sending money abroad and has inbuilt features to buy crypto and stocks. There are also some types of insurance coverage available.

Revolut has 4 accounts, ranging in price from free to £12.99 a month. Each one of these gives you different access to the features above. The table below shows how it breaks down at the time of writing:

Everyday Features

Here are the basic features of the account.

| Standard (Free) | Plus (£2.99 monthly) | Premium (£6.99 monthly) | Metal (£12.99 monthly) | |

| Free ATM withdrawals (2% after)* | £200 a month or 5 times | £200 a month | £400 a month | £800 a month |

| Personalised cards | No | Yes | Yes | Yes |

| Metal card | No | No | No | Yes |

| Cashback of up to 1% on foreign transactions outside UK and Europe | No | No | No | Yes (limits may apply) |

| Junior accounts | 1 child | 2 children | 2 children | 5 children |

| Junior Features | No | Yes | Yes | Yes |

| Priority 24/7 priority support in the app | No | Yes | Yes | Yes |

| Daily interest for GBP savings | Up to 2.29% AER | Up to 2.39% AER | Up to 3% AER | Up to 4% AER |

*Note: The ATM provider might charge you.

Revolut also offers “on-demand pay” that allows you to access your salary early. It’s a nice idea but employers have to register with Revolut to allow this to happen and we’re pretty sure this isn’t widespread yet.

However, even if your employer has not registered, if you have your salary paid into your account you can choose for Revolut to credit the funds to your account a day early with no fees via their “early salary” feature.

Investment

Revolut also has features for those wanting to buy crypto and invest – we really haven’t seen anything like this with any other account. They have access to over 1,500 public companies you can buy shares in.

| Standard (Free) | Plus (£2.99 monthly) | Premium (£6.99 monthly) | Metal (£12.99 monthly) | |

| Crypto exchange fees | 1.49% (min £1.49) | 1.49% (min £1.49) | 1.49% (no min fee) | 1.49% (no min fee) |

| Commodity exchange fees | 1.99% (minimum £1) | 1.99% (minimum £1) | 1.49% (minimum £1) | 1.49% (minimum £1) |

Travel and Protection

Spending and sending money internationally with Revolut is generally a good choice compared to banks.

You can spend in over 140 currencies. Also, Revolut uses the real mid-market exchange rate which is typically much better than the rates you are offered via banks. This is what makes it one of the most attractive cards for spending abroad.

However, if you do this at the weekend the markets are closed so Revolut adds a small markup of 1%. Fair usage limits also apply on the Standard and Plus accounts, while the Metal and Premium accounts can apply fees for “exotic currencies” – though there are 30 currencies that are free.

If you’re travelling a lot the higher tier plans may be for you – especially when you throw in the insurance and benefits laid out in the table below.

| Standard (Free) | Plus (£2.99 monthly) | Premium (£6.99 monthly) | Metal (£12.99 monthly) | |

| International Spending | Yes | Yes | Yes | Yes |

| No fee for sending money abroad during the week (1% markup at weekends) | Yes | Yes | Yes | Yes |

| Currency exchange with no fees in 30 countries on weekdays | £1,000 monthly | £1,000 monthly | Unlimited | Unlimited |

| Cashback on accommodation booked through Revolut Stays | 3% | 3% | Up to 5% | Up to 10% |

| Overseas medical insurance | No | No | Yes | Yes |

| Car hire excess insurance | No | No | No | Yes |

| Delayed flight and baggage insurance | No | No | Yes (up to £1k) | Yes (up to £1k) |

| Winter sports cover | No | No | Yes (up to £3k) | Yes (up to £3k) |

| Free lounge access with SmartDelay | No | No | You + 1 friend | You + 3 friends |

| Discounted airport lounge access | No | No | Yes | Yes |

Revolut Savings Vault

Revolut can also set you up a savings accounts called “vaults”, which pay out up to 4.75% in annual interest paid daily. At the time of writing, these have decent rates but with them changing frequently at the moment it is worth checking out the latest rates here. It’s worth nothing that as your svaings will be held in a partner bank they will be protected by the FSCS up to £85,000.

You can also switch on the “spare change” feature. Essentially it rounds up your purchases to the nearest pound and puts the difference in your savings fault. For example, if you bought a beer for £3.20 it would automatically round this up to £4 and put 80p into your savings vault.

The vaults can be given names such as “taxes”, “holiday” or whatever it is you are saving for. You can also have a shared vault with friends and family members if you are saving towards a common goal.

What We Like About The Account

It’s genuinely revolutionary. Great international travel benefits, loads of insurance options and even the ability to buy stock and crypto. There really isn’t another account that allows you to do all of this.

For those who travel a lot this card is really worth considering. The savings vault is a nice feature too with competitive rates right now.

What We Don’t Like About The Account

There’s no way to speak to someone if things go wrong. You have to contact a rep through the app. If you’re on the lowest tier you won’t get priority support either – however, we have seen user comments saying they have still got a response within a few minutes even without being on a paid plan.

Additionally, some users have reported issues with account freezes

How good is the app?

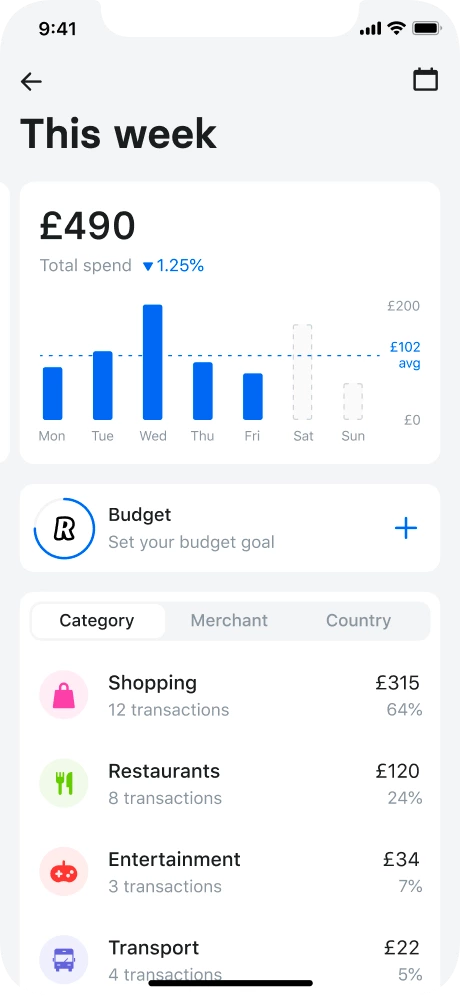

Fantastic. As you can see above it has a shed load of features that you can access through the app. You also get the standard functions of seeing your transactions, the ability to block cards and change your details. It works with Apple Pay and Google Pay as you would expect from any modern bank.

Other features include instant notifications, the ability to split bills and “pockets” which allow you to set money aside for upcoming purchases so you have a better idea of how much uncommitted money you have. There are also cashback and reward offers for various retailers – though they vary and are subject to availability.

You also get a nice category breakdown of your spending and the ability to set budgeting goals.

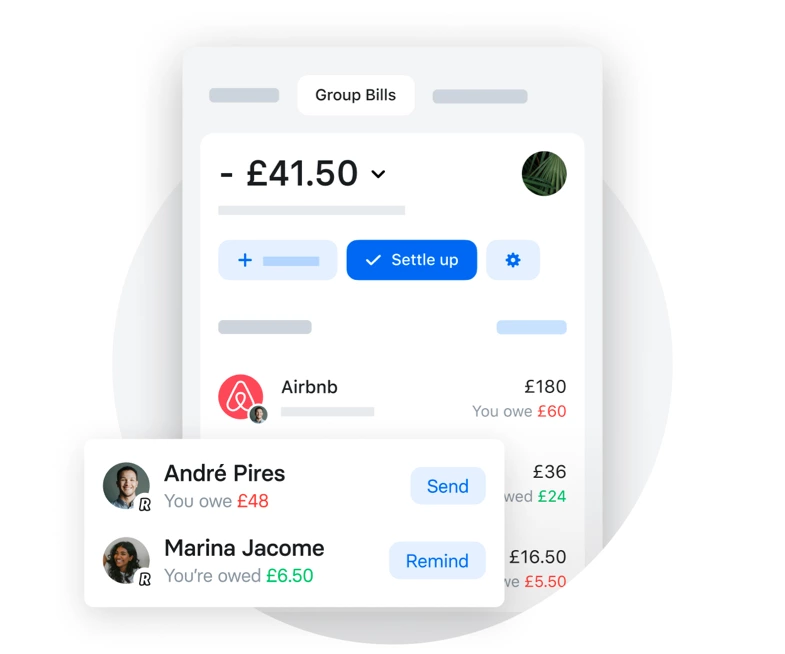

Group Bills is another tool that shows how Revolut are always trying to innovate. This allows you to invite friends and family to a central group to share an expense. The catch at the moment is that it only works for fellow Revolut users.

You can also set up “virtual cards”. These are cards you can access through the app with their own long card numbers, CVCs and expiry dates. You can then use these to spend online. This is great if you want extra security online. You can also set limits for cards which could be useful if you wanted to budget in this way.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5/5

Good for FX and Travel

Much lower fees than other providers esp. with the metal plan. Not perfect – Junior Card limits can not be modified, ATM limits do kick in at some point etc. but tech is head and shoulders above rest.

4/5

Tried, trusted and reliable

I just love Revolut. I’m a personal and a business customer because it does what it says it all. They are great value, offer comprehensive services at low cost and the FX and expenses Services knock everyone else into a cocked hat.

5/5

Fintech innovation at its finest!

I’ve tried a dozen different banks and none of them compare to Revolut. Love the invest feature with exposure to stocks and crypto. Metal card and cash back is great. Fast secure and easy to use, can’t fault it at all!

Critical

4/5

Versatile, unique and forward thinking

Unique features such as free stock trading, crypto currencies and the ability to open up up foreign accounts under your name. However, the lack of over drafts and interest may put off prospective users.

2/5

Always locking accounts !

I cannot trust revolut any more as my accounts got locked for no reason about five time this year. I provide right documents but it is an avalanche of nonsense for supposed compliance reasons. Lucky anytime did the job. I m searching for a new bank, that i can rely on. I felt trapped many times this year with being a revolut customer.

Superb tools, great concept, revolut could be my first choice and i had i. The past so much love for it. Until this huge problem popped, and stayed always. I have a correct business, with proofs of everything. They don t seem to care about customer s experience and problems.

2/5

Unreliable

They keep “pausing” access to our accounts for regular KYC checks. Infuriating and unnecessary. We are given 20 business days to respond – then the accounts are frozen after 5days!!! Totally unpredictable and impossible to rely on.

Is Revolut Any Good?

Revolut is ranked #5 of 25 personal current accounts in the UK (Click to see full list).

The information in this article is for general information purposes only and does not constitute financial advice. If you have any questions about your personal circumstances please seek professional and independent advice.

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.