The Two Minute Review

NatWest is a safe and well-established high street bank, with a large branch network and some interesting perks on its reward accounts. However, it is hard to get excited about this bank. Its customer service is not the best and others on the market offer better rewards and a better digital experience.

PROS

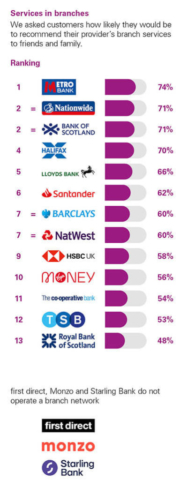

- 🏦 Lots of branches.

- 💰 Often has great switching offers.

- 📱 Nicely designed app.

CONS

- 😑 Rewards are not super exiting.

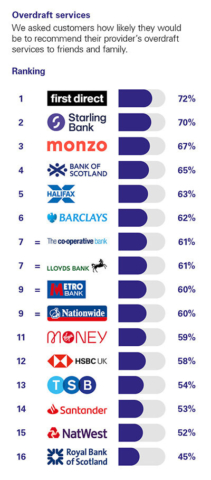

- 💸 Interest on overdrafts is high, as are the international spending fees.

Ranked #10 of 25 personal current accounts in the UK.

What The Experts Say

On the app: “… there are a few key features lacking in the app, including the ability to order a new card if yours is stolen or misplaced. “

What Users Say

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put Natwest in tenth position overall.

Click to see the full picture.

1.4/5

NatWest has a Trustpilot rating of 1.4 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 1.38. In terms of organic Trustpilot rating this means NatWest is number 20 out of the 25 personal banks/current accounts we review.

4.2/5

At the last check, Smart Money People had collected 1,841 reviews which gave NatWest an average score of 4.2 out of 5.

The Deepdive

NatWest in a Nutshell?

NatWest Bank is one of the largest banks in the United Kingdom. It offers a range of financial services including personal banking, business banking, and wealth management. The bank has over 1,600 branches across the UK and employs around 28,000 people. Natwest was founded in 1968 and is headquartered in London. In 2017, the bank had total assets of £333 billion and reported a profit of £1.6 billion. NatWest is part of the Royal Bank of Scotland Group, which also includes the RBS and Ulster Bank brands. The group operates in 36 countries and serves around 24 million customers worldwide.

In 2018, it was named one of the world’s most sustainable banks by Bloomberg.

Opening a NatWest Account

To open a new NatWest account online, you’ll need to provide some personal and financial information. This includes your name, address and date of birth. You’ll also need to have an email address and a mobile phone number. They will also ask for photo ID and then do a “likeness check”. This is basically a short selfie video to verify that you are the person on your ID.

What Accounts Does NatWest Offer?

There are a few accounts to choose from:

Select Current Account

This is Natwest’s standard, everyday current account. It doesn’t have any rewards but it doesn’t have any recurring monthly fees either.

It won’t rock your world, but you do get access to a big bank that’s regulated by Financial Conduct Authority and protects your deposits up to £85,000 via the Financial Services Compensation Scheme. It also has a decent app with some nice features such as roundups (our full review of the app is below).

However, we don’t love that interest is charged on overdrafts right away and at the eye-watering level of 39.49% EAR. You also won’t get paid interest on your balances and purchases abroad are charged at 2.75% of the total cost (3% if withdrawing cash with a minimum of £3).

Reward Account

This is the same as the Select Current Account but comes with a fee in exchange for the opportunity to earn rewards.

The fee is £2 a month and you will also need to pay in £1,250 each month. In exchange for this you can earn:

- A reward of £5 a month. £4 is given when you pay two Direct Debits of at least £2 each from the account each month. The extra quid comes in exchange for logging into mobile banking once a month.

- Get 1% cashback at certain retailers. Currently, these are Caffe Nero, EuropCar, Barrhead Travel, Boux Avenue and ATG Tickets.

It is an OK deal that most people will be able to make a profit from – but we would weigh it up against the Chase Current Account which is currently offering 1% cashback on everything.

Like the standard account, overdrafts are charged at 39.49% EAR, you won’t get interest on your balances and there is that 2.75% fee for international purchases.

Reward Silver and Platinum Accounts

Once you are an existing customer, you can upgrade your Reward Account to Silver or Platinum. These accounts have everything the standard reward account does, but they also offer some extras on top (for a price).

| Silver | Platinum | |

| Monthly cost | £10 | £20 |

| Travel insurance | European | Worldwide |

| Mobile phone Insurance | Yes | Yes |

| Fee-free foreign card purchases | Yes | Yes |

| Tastecard | Yes | Yes |

| UK car breakdown cover | No | Yes |

| Monthly reward for setting up 2 Direct Debits (at least £2 each) | £4 | £5 |

| Monthly reward for logging into the mobile banking app | £1 | £1 |

If you’re currently paying separately for mobile, travel and breakdown cover then the Platinum account could be a clever move.

Premier Accounts

NatWest also has some premier accounts, but the requirements are incredibly onerous. You must fulfil one of the following criteria:

- Earn 100k salary (or 120k join salary) and pay this into NatWest.

- Have a £500k or greater mortgage with NatWest.

- Have £100k in savings or investments with NatWest.

Even then you will only earn £10 a month from the Premier Rewards account for having 2 Direct Debits and logging into mobile banking!

Features We Like

- The reward accounts will suit some.

- Lots of branches.

- A safe bank regulated by the FCA and backed by the FSCS.

Features We Don’t Like

- Customer service is middling.

- Loads of (very high) hoops to jump through to get a premier account.

- Interest is charged as soon as you enter your overdraft (First Direct for example gives you £250 interest-free).

- The international purchase and ATM withdrawal fees mean we wouldn’t recommend it for travelling.

How Good Is The App & Digital Banking?

The NatWest app is cleanly designed, simple to use and has some nice graphics. You can do all the basics you would expect like checking your balance and making transfers. It also has a few features that you might not expect from a high street bank.

One is a “round-ups” feature that allows you to round up your purchases to the nearest pound and put the difference into savings. So, for example, if you bought a newspaper for £2.40, you would be charged £3 overall with 60p going into your savings.

Another is the “Get Cash” facility that allows you to withdraw up to £130 from an ATM even if you don’t have your card on you. It also offers a visually attractive breakdown of how you are spending your money by category.

Bizarrely though you cannot order a new card or view your pin through the app.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5*

Very secure banking

I recently had money taken from account without authorisation. They refunded the money back to my account the very same day. There security is excellent. I regularly have E-mails when something out of the ordinary is requested from my account.

5*

Happy to bank with natwest

I had been with Barclays for 15 years before I switched to Natwest. Everything about them is better. They are more accessible, friendly… Available! They have local branches that are still open and even offered me a zoom call with a specialist to see about my savings goals. App is really easy to use and secure also!

5*

Human contact

I usually bank on line – which is great with NatWest. However whilst at the solicitors in town I found I was missing a document. To save time I visit a local Branch. I was so surprised and delighted when, on entering the bank I was greeted by a human being! A rarity indeed. I was introduced to the correct person who could deal with me and provide the information I needed. I was treated with the utmost curtesy, the information I needed was printed off for me , popped in an envelop and handed to me with a smile. What a pleasant experience ; It was refreshing to know that when in need I can indeed speak to a real person.

Critical

1*

Awful Customer Service

Always took ages to get through on the phone and then staff were not very helpful and more than one error on my bank statements. Wouldn’t go with again

2*

Need to be more ethical

I switched to a bank that do not invest in fossil fuel as I thought nowdays even a small gesture can be important. I appreciated their commitment to phase out coal investiment, but I fell that 2030 is still too far as the situation require immediate action. I have encouraged relatives and friends to do the same.

Is Natwest A Good Bank?

NatWest is ranked #10 of 25 personal current accounts in the UK (click to see full list).

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.