The Two Minute Review

Lloyds may not be stellar in any particular way, but its combination of better than average customer service, clean app, interesting rewards and interest (paid on certain accounts) means it could be worth checking out when they have a switching offer.

PROS

- 🏦 Lots of branches and good customer service (though waiting times can be quite long on the phones).

- 🙂 Club Lloyds in an all-rounder account.

- 🙂 Platinum account’s range of cover could be of interest to some.

CONS

- 📱 App fine but lagging features of challengers (such as savings pots or split the bill).

- 🌎 Foreign transaction fees and interest on overdraft can be high.

Ranked #12 of 25 personal current accounts in the UK.

What The Experts Say

On the app: “take advantage of the spending categorisation and round up spare change features, although it doesn’t have advanced budgeting tools to rival the likes of the newer, digital-only challenger banks such as Monzo and Starling.”

What Users Say

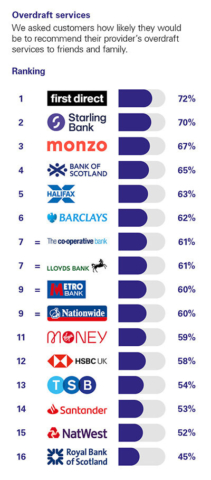

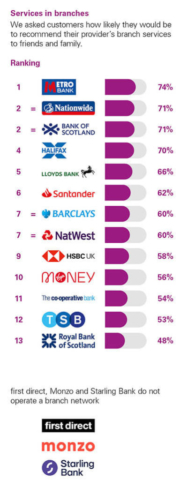

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put Lloyds in joint 7th position.

Click to see the full picture.

1.5/5

Lloyds Bank has a Trustpilot rating of 1.5 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 1.44. In terms of organic Trustpilot rating this means Lloyds Bank is number 16 out of the 25 personal banks/current accounts we review.

3.7/5

At the last check, Smart Money People had collected 1,590 reviews which gave Lloyds an average score of 3.7 out of 5.

The Deepdive

Lloyds in a Nutshell?

Lloyds is one of the UK’s “big four” banks. It has over 1,200 branches in England and Wales and employs over 45,000 people.

Opening a Lloyds Account

It’s a fairly easy process. You can apply online and usually get a decision within 10 minutes. You’ll need to be over 18 and live in the UK. You’ll also need proof of ID (driving licence, passport or biometric residence pass).

What Accounts Do they Offer?

Classic Account

This is just really a bog standard account. You get a contactless card you can add to Google and Apple play. Access to their app (see review below) and free ATM withdrawals in the UK.

While fine, if unexciting, for use in the UK we wouldn’t advise you to travel with this card. You will be charged 2.99% for buying things in foreign currencies and a £1.50 fee on top of this if you withdraw foreign currencies – which isn’t great! The exchange rate also isn’t set at the mid-market rate, meaning the bank takes an additional markup.

You do get access to some cashback offers. These have to be manually activated individually via the app. It’s not true rewarding banking but occasionally an offer can be handy. A typical offer would be 10% off at Costa or 8% off at Fat Face.

One thing to note is that you get access to Lloyds Monthly Saver with any Lloyds account. This is an easy-access savings account (i.e. you can take your money out at any time) that is currently offering 4.5% gross/AER across the first 12 months. The interest is paid after 12 months.

Club Lloyds Account

This account comes with a £3 monthly fee but if you pay in £1,500 a month then this fee is waived. There are a few benefits you get with this account:

Interest rates on your balance. You get 1.5% AER on balances up to £3,999 and then 3% on balances between £4,000 and £5,000.

There are better saving rates than this on the market, but it’s a nice add-on as lots of current accounts do not offer you interest on your balances. However, to qualify you will need to pay in two Direct Debits a month.

An Extra Perk. You can choose one across the year:

- 6 tickets to ODEON/Vue Cinemas.

- Annual magazine subscription.

- 12 x digital movie rentals from Rakuten TV.

- A digital membership to The Gourmet Society (this gives you money off restaurants like Pizza Hut, Bella Italia and Prezzo).

You get also get the same access to the Lloyds Monthly Saver account as the Classic Account.

You can also apply for an arranged overdraft as part of sign-up. While you get a £50 interest-free buffer on these afterwards the interest jumps to a hefty 27.5% EAR.

Silver Account

This account will set you back £10 a month. You get everything you get with the Classic Account, but you also get:

- UK and European multi-trip travel insurance. This is for you and your family and it includes cover against cancellations, medical issues and loss of your belongings. It also extends to winter sports, golf and UK breaks.

- Mobile phone insurance. This goes up to £2000 covering loss, theft, accidental damage and breakdown. Maximum one phone per account holder.

- AA Breakdown Family Cover with Roadside Assistance.

Platinum Account

This account will set you back £21 a month. With this you get:

- Worldwide multi-trip travel insurance. This is for you and your family and it includes cover against cancellations, medical issues and loss of your belongings. It also extends to winter sports, golf and UK breaks.

- AA Breakdown Family Cover with Roadside Assistance, National Recovery and At Home.

- Mobile phone insurance. This goes up to £2000 covering loss, theft, accidental damage and breakdown. Maximum one phone per account holder.

Again it can offer £50 interest-free overdraft but after this interest will kick in (you should check the interest rate applicable to you).

Lloyds also has the option for accounts for under 19-year-olds. You can also choose the Club Platinum account which a mash-up of the Club Lloyds and Platinum accounts.

Features We Like

- The benefits will suit some, especially on the platinum account.

- Interest paid on Club Lloyds balances.

- Easy to avoid Club Lloyds fee.

- Club Lloyds is an all-rounder account with interest, rewards and an OK app.

Features We Don’t Like

- The 2.99% fee for foreign transactions plus an extra £1.50 when you withdraw cash isn’t a good deal.

- The app is OK but could be better.

How good is the app and digital banking?

Lloyds’ app is clean and simple. It allows you to check balances and transactions, change your details, freeze your card and other basics. However, it has a couple of cool features (for a high street bank).

- Everyday offers – you have the ability to turn on some cashback rewards. At the time of writing a couple of examples are 10% off at Franco Manca and 10% off at Greene King.

- Save the Change – the ability to round up transactions and automatically put the difference into a Lloyds saving account. So if you bought a pint for £3.40 it would round this to £4 and put 60p into your savings account.

- Upcoming payments – this allows you to see and cancel upcoming recurring payments from within your app. Really handy if you sometimes get lost with subscriptions you have signed up to.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5/5

Outstanding established bank

A fine example of an established institution nimble enough to move with the times. Adapted well to upgrade itself to remain competitive in the face of app based challenger banks whilst maintaining that aspect the challengers will never have: human face to face contact in-branch.

4/5

One of the better traditional banks

Lloyds feels safe as one of the traditional banks, but has good online banking and an excellent app, plus the Club Lloyds account does give some genuine benefits to a straightforward current account.

4/

Great rewards!

The Lloyds Club account has amazing benefits. You can choose 1 of 3 lifestyle benefits such as 6 cinema tickets, an annual magazine subscription or annual Gourmet Society membership. You get these renewed every year! We choose the cinema tickets and enjoy some free family days out. You can also earn monthly credit interest. There is no fee with this account if you pay more than £1500 into it per month, and £3 if you don’t. Overall I would definitely recommend this account.

Critical

1/5

Lazy

The local branch closed. There are few staff available at the closest branch. They pay next to nothing in interest on this and the savings account. And when I needed to pay in a cheque from the USA they charged a small fortune for a process that costs next to nothing.

1/5

Poor overall service.

After more than one year being a Lloyd’s client, I decided to close down my bank account due to the poor overall service this bank provides. These are just some of the reasons:

Opening an account in Lloyds is a painful-process: First, there is no chance to open an account online as you need to bring documentation to the bank after completing the application online. As most banks do, they request you proof of ID and proof address to complete your application. However, you must bring them to bank whilst other banks let you send them online. Additionally, when bringing those documents to the bank, you always feel they’re trying to find any excuse to refuse them. Personal experience example: They send you an email stating they can accept a letting agreement as a proof of address if the document has been issued by an agency. I brought this document as a proof of address to the bank and they told me they can’t accept it since it was issued by a high street agency (“additional” information NOT specified in the email they send you). Obviously, I wasted my time bringing another document the day after. In addition, when opening another bank account (second, third…), they request you again to bring a proof of ID and proof of address (when you are a client already). Considering that you can open a new account in other banks in less than 5 minutes (via online), this service in Lloyds is simply not good enough. App. I’ve always experienced issues finding information through Lloyd’s app (example: Download a bank statement – PDF). The information is not displayed/structured clearly. I have used other banking apps (Metro, Santander, Revolut…etc) and I strongly think they are much better. Opening hours. Most of the branches are not open after 5-6 p.m For obvious reasons, this is an issue if you work during office hours. Other banks open until 8-9 during the week, so you don’t need to wait till weekend or find a moment at work if you need to go the bank. Considering all the reasons above, I can’t find a single reason to open an account in Lloyds and I’d never recommend this bank, since there are multiple banks in the UK that provide a much better service.

Is Lloyds A Good Bank?

Lloyds Bank is ranked #12 of 25 personal current accounts in the UK (click to see full list)

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.