The Two Minute Review

HSBC is a banking giant, but it has fallen behind banks such as Starling and Monzo when it comes to app experience and doesn’t offer much in the way of rewards for most customers.

PROS

- 🏦 Large branch network.

- 🔒 Accounts protected by FSCS up to £85,000.

CONS

- 😐 Customer service not the best.

- ✈️ Fees for most customers using card abroad.

- 💰 Lack of rewards.

- 📱 Dated digital experience.

Ranked #19 of 25 personal current accounts in the UK.

What The Experts Say

On the app: “While the app itself doesn’t contain any real budgeting features, the accompanying “Connected Money” app does offer these.”

What Users Say

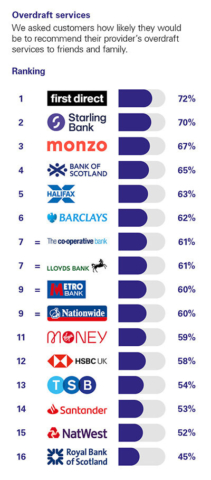

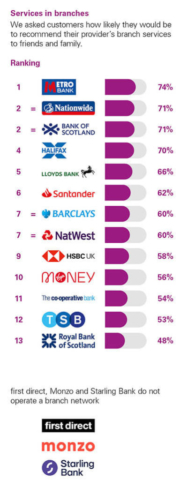

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put HSBC in 11th position.

Click to see the full picture.

1.4/5

HSBC has a Trustpilot rating of 1.4 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the score stays the same (unlike with some other banks). In terms of organic Trustpilot rating this means HSBC is number 22 out of the 25 personal banks/current accounts we review.

3.5/5

At the last check, Smart Money People had collected 1,460 reviews which gave HSBC an average score of 3.5 out of 5.

The Deepdive

HSBC in a Nutshell?

HSBC is a true banking giant. It is the world’s sixth-largest bank by total assets ($2.97 trillion in 2022). The bank was founded in 1865 and has grown through a number of mergers and acquisitions. The company operates in 74 countries and has over 6,000 offices worldwide.

In the UK there are 441 branches, but not all of them offer the full range of services. This is how they break down.

- 96 Full-Service Branches: These offer all traditional bank branch services and are usually based in metropolitan areas.

- 172 Cash Service Branches: These support local communities with access to simple over-the-counter services and some more complex ones (e.g. power of attorney).

- 173 Digital Service Branches: No counters in these branches. If you want to pay in a cheque, for example, you would do so via a self-service machine.

Opening an HSBC Account

You can open an account in a branch, but online is easier and quicker. You will need one of the following ID documents:

- Passport

- EEA/EEA National Identity card

- UK driving licence

If you use a full photo driving licence this can also be used as your proof of address. If not, you will additionally need to provide one of the following to prove where you live:

- Utility or council tax bill (a sky or cable bill is sufficient).

- HMRC tax notification or a personal tax summary.

- Mortgage statement.

- “Department for Work and Pensions, Jobcentre Plus or Veterans UK letter confirming your right to benefits”.

The whole application process takes about 10 minutes and most accounts can be opened within 48 hours.

The Types of Account

HSBC Bank Account

This is HSBC’s standard account. You get all the basics like access to the app, the ability to pay friends, contactless payment and Google/Apple pay if you want it. You also get access to their “regular saver” pot which allows you to save between £25 and £250 each month and earn 5% interest on your savings (you should note that to get the 5% you cannot withdraw your money for 12 months).

You can also get access to their exclusive offers which are usually time-limited deals like 10% off at Hello Fresh etc (you can get a sense of them here).

The best thing about this account is that you can apply for an overdraft, the first £25 of which is interest-free. This is a nice buffer for those that fall a bit short of the end of the month. Be careful though, as the interest is 39.9% for amounts over £25!

HSBC Advance Account

We’re not entirely sure this lives up to the name “advance account” as, being frank, it doesn’t offer a whole lot more than the more basic Bank Account.

To get this account you will need to qualify for a £1,000 overdraft.

HSBC Premier Account

This one does actually have some clear benefits. You get free annual worldwide travel insurance (including winter sports) from Aviva and this extends to your children and grandchildren. You also get a £500 interest-free arranged overdraft (subject to successful application) and preferential mortgage rates.

However, to get the account you will need to fulfil one of the following:

- Have an income of £75,000 and either a mortgage, investment, life assurance of protection product with HSBC

- Have £50,000 worth of savings or investments managed by HSBC

- Qualify for HSBC Premier in another country.

So all in all, it’s pretty difficult to get this account but worldwide travel insurance is a nice bonus if you do.

Note: On all accounts, you get charged a 2.75% fee for using your card abroad. HSBC also uses its own exchange rate which might not be the same as the real “mid-market” rate. This means you may not get the best deal on conversion. If you withdraw money abroad you won’t be charged a fee if you have a Premier account, but all other account holders are charged 2%. We really wouldn’t recommend HSBC for travel.

How Good is the App and Digital Banking?

One of the most annoying things about HSBC is the need for a “Secure Key”. These are the calculator-type machines that generate secure keys when you need to log onto online banking. It can be quite an inconvenience for people moving from other banks who are not used to this type of two-step process. It has got a bit easier recently since you can now use an app on your phone to do the same thing – including using your thumbprint or face ID as verification (if your phone has these features).

The app itself is fairly basic. It doesn’t have the snazzy features of the challenger banks like savings goals, budgeting tools or split-the-bill features. However, the basics like viewing your transactions, balances and transferring money are covered.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

5*

Excellent

Very pleased with the service i receive from my bank. The physical building is staffed by helpful, knowledgeable people, and the online process is simple and easy. Would recommend highly.

3*

Trustworthy and straghtforward

HSBC are very straightforward and provide easy banking, online and by telephone as well as in store. There are times when it feels as though they don’t talk to each other between departments but for the most part they are a good bank to go for.

Critical

4*

Good app but lacks dashboards

It would be great if HSBC could imitate challenger banks and segment my spending by categories

1*

HSBC is still in the 20th Century

Huge mistake moving my account to HSBC Premier. The simplest tasks take an age, constant form filling by post. A letter from HSBC takes 14 days to receive and they attempt to blame Royal Mail. Their chat people are clueless and lie . Avoid

1*

Poor customer service overall

Poor customer service overall, hard to reach, and sometimes difficult to understand.

Is HSBC A Good Bank?

HSBC is ranked #19 of 25 personal current accounts in the UK (click to see full list).

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.