The Two Minute Review

Ethical banking? A definite yes. However, when it comes to customer service, account rewards, and modern digital banking the answer is less positive.

PROS

- 💪 A bank with principles.

- 👛 £15 a month for breakdown cover, travel and phone insurance on the Everyday Extra account.

- 🙂 Easy to open.

CONS

- 🪙 Account rewards max out at £2.20 a month.

- 📱 App could be better.

Ranked #20 of 25 personal current accounts in the UK.

What The Experts Say

3.3*

The Times awarded the Co-Op Bank 66% overall. While transparency was high at 76%, customer happiness was only 63%.

What Users Say

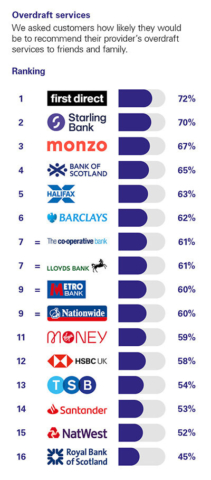

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put the Co-Op in 13th position.

Click to see the full picture.

1.3/5

Co-operative Bank has a Trustpilot rating of 2.7 but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is actually 2.17. In terms of organic Trustpilot rating this means Co-operative Bank is number 7 out of the 25 personal banks/current accounts we review.

3.7/5

At the last check, Smart Money People had collected 430 reviews which gave the Co-Op an average score of 3.7 out of 5.

The Deepdive

Co-operative Bank in a Nutshell?

The Co-operative bank aims to be Britain’s most ethical high street bank. It was founded way back in 1872, but in 1992 introduced its “Ethical Policy” – the latest version of which was published in 2020. It aims to commit the bank to people, the planet and community with commitments to:

- Preserving animal welfare

- Reducing climate change

- Being an ethical employer

- Only working with businesses that share their values

Each year they publish a sustainability report to measure themselves against their aims.

The bank has over 3,000 employees and 50 branches across the country.

Opening A Co-op Account

It takes about 10 minutes to apply online. You have to be over 16 (over 18 if requesting an overdraft), not have any CCJs, not have been declared bankrupt in the last 6 years and be a UK resident. Additionally, you will need the following info:

- Your previous address if you’ve not been at your current address for 3 years

- Your income – gross salary, regular income before tax, state benefits and pension

- Details of your employment

- Sort code and account number of your main current account (if you have one)

When opening an account you can apply for an overdraft or you can choose to use the Current Account Switch Service to move another account over.

Type of Account

There are really two accounts worth looking at from the Co-op. Their standard account, called “Current Account”, and the “Everyday Extra” account.

Co-op Current Account

There is no fee for this account, and you get a fairly straightforward banking experience. A nice touch is that you get a PVC-free contactless card (which can be used with Apple and Google pay).

There are also some rewards on offer – you get £1 a month cashback plus 2p every time you use your debit card (up to £1.20). This will be paid into your account on the last day of the month. However, you do need to meet the following criteria each month:

- Pay in £800.

- Stay in credit or within your arranged overdraft.

- Log in to online banking.

- Get paperless statements.

- Pay out 4 direct debits.

However, there are much more rewarding accounts available elsewhere at the moment (some of which have a switching bonus).

Subject to a credit check, you can apply for an overdraft which will be charged at a heavy 35.9% yearly interest.

Co-op Everyday Extra Account

This is Co-op’s premium account. It costs £15 a month and for this, you get all the things you do with the standard account plus:

- Worldwide travel insurance (provided by AXA)

- UK and European breakdown cover (provided by RAC)

- Mobile phone insurance (provided by Lifestyle Services Group).

So long as you will make us of all these insurances, this is a pretty competitive deal.

There are some restrictions on this account – e.g. you are not eligible if you are over 79 or live in the Channel Islands or the Isle of Man.

Note: Co-op also has a basic account called Cashminder, which is really designed for people with poor credit. You don’t get access to rewards or an overdraft. You also can’t request a chequebook.

How Good is the App and Digital Banking?

The app really only covers the minimum you would expect from a modern bank such as viewing transactions, balances and moving money around. It doesn’t have more advanced budgeting features that have become commonplace with more recently founded banks or, indeed, some progressive high street banks. App reviews are quite negative too – on the App Store Co-op only gets 2.5 stars with users complaining about being kicked out of the app frequently.

User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive and critical comments that stood out to us:

Positive

4*

Banking with principles

Good to know that my money will not be invested in fossil fuels, arms, dictatorships or exploitation.

No problems with my account or customer service. Easy to use app and website. Only downside is (now) the lack of a local branch but it is only VERY occasionally that I have cause to visit a branch anyway.

4*

Still more ethical than most

Hugely appreciate the UK call centres too

5*

Everyday Extra Account

Great value account includes travel insurance and roadside assistance for £15 a month. You can also get cash rewards when you pay out on standing orders. It’s easy to manage the account online.

Critical

2*

Call time is very long and customer service reps do not always deliver

The call times are always very long – then when you do get through the customer service reps do not always do what they say, e.g. send emails – then you have to call back and wait on hold again for another hour.

Is The Co-operative Bank A Good Bank?

Co-operative Bank is ranked #20 of 25 personal current accounts in the UK (click to see full list).

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.